These are unique times we are all experiencing. To help our clients we write a special macro newsletter to help them in their investing. This is the 3rd email we sent our clients, about the government & the Fed’s plans to stimulate the economy. This is the email:

Lately, we see huge efforts from governments to fight the Coronavirus and stimulate the economy. These efforts involve huge money spending and in the US it is often via the Fed. I wrote this article to help understand what is going on.

It seems that the Fed is re-writing the Economy textbooks, which is an understatement; it shredded the books and are now rewriting them as it goes.

This is the bottom line: The US government is using the Fed to print money to make sure that there are no areas in the economy that don’t have cash at hand. It is not supposed to “solve” the crisis, but more to act as a “safety net” and make sure the economy functions “smoothly”.

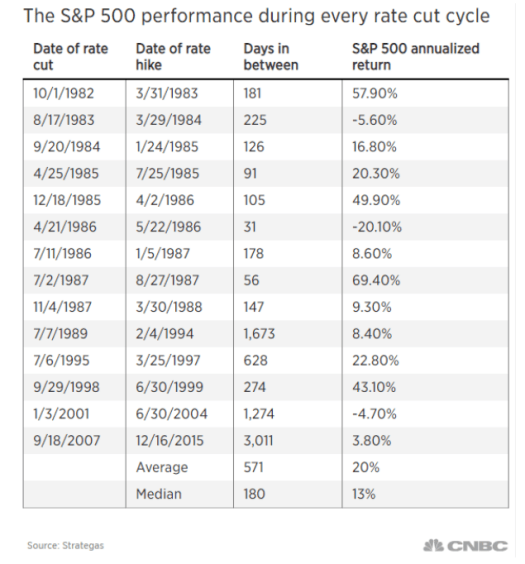

A common investing quote reads “Don’t fight the Fed”. While this quote is a bit naïve – there are many things that affect the stock market, not just the Fed. The general consensus is that as investors, it is best to invest with the direction of the Feds actions. The following table shows the S&P 500 performance during the Fed monetary expansion:

As mentioned before, the Fed doesn’t have the ability to solve the crisis, but it injects an unprecedented amount of cash into the economy. We are in uncharted territory, so it will be very interesting to see how it will turn out.

Listed below are a summarized explanation of the current stimulus plan.

- Interest Rate decrease: The Fed decreases the IR range to 0%-0.25%. It will pay 0.1% interest on deposits it holds from other banks and will buy Gov. bonds with an unlimited budget (dubbed “QE Infinity”). These actions will inject money into the economy and increase the liquidity in the system. This causes a risk for inflation, but as I said, the Fed shredded the Economy books and probably does not see a risk with uncontrolled demand for cash.

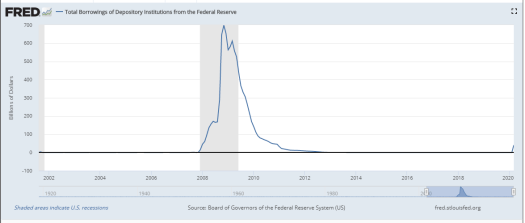

- Decrease the Discount Rate: The Fed is also a lender of last resorts; it can give loans to banks. These loans have an awfully bad reputation in the market as it could indicate that no one else is willing to lend to the borrower. The Fed decreased the load rate to 0.25% (a competitive rate) to try and shake off the negative stigma. Looking at the data it seems like it is starting to work:

(https://fred.stlouisfed.org/series/BORROW)

- No Reserve Ratio – This goes directly against the Econ books. The reserve ratio is the ratio commercial banks need to keep between the deposit they have and the loans they give. A reserve ratio of 10% means that for every $1 in deposit a bank has, it can create $10 in loans. Without this rate, the risk is that the banks can generate as much money as they want. The rationale behind this decision is that after 2008 the banks must hold to much more rigid ratios (called Basel framework/ Basel Accords) so this ratio became absolute. I think that the Bael accords were built with the reserve ratio in mind, but so far the data supports this decision; meaning the banks can’t create an infinite amount of cash cause they need to hold to more complete ratios that are defined by Basel accords

- Loans for businesses and individuals: The Fed announced 3 plans that are geared to providing loans to different verticals. The plans are built in a similar way: The Fed creates a company (Special Purpose Vehicle). The US government invests equity, and the Fed loans this SPV the rest of the money. The SPV is then used to give loans to the different verticals (The money is the Fed’s but the losses are the government’s). In my opinion, this is a very roundabout way to accomplish what they are trying to do. I think it is done because (1) they want to avoid ‘printing money’ (so they give loans to SPVs) and (2) it is not exactly legal – the Fed is defined as a last resort lender, and it should be limited outside the financial markets (the court ruled that the 2008 buyout of AIG was illegal). I am guessing this issue will be argued in court in the future as well. The different plans: TALF, PMCCF, and SMCCF are each geared to solve a different vertical, but all are built in a similar way.

- Provide liquidity to the financial markets – The financial markets are kind of invisible to most people, until they do not work as expected. The Fed is trying to get ahead of the problem and is providing a lot of liquidity (cash) to different verticals of the markets in order to keep them working, even in case of extreme inefficiency (the negative oil case shows what happens when the financial markets encounter unexpected and extreme crisis). The different plans: CPFF, PFCF, and MMLF are all buying financial instruments from institutional players in order to provide them with more cash to continue their operation and protect them from loss.

- Main Street Lending Program – Early April the Fed announced another unique plan to provide liquidity to “regular” businesses in the US. This plan is similar to the plans in the 4th section and the Fed customized it a bit and will improve it based on criticism it got for the other plans. The Fed will, again, create an SPV where the government invests equity and the Fed will give loans to. The SPV will buy loans from banks to businesses that have revenues of less than $2.5B and fewer than 10,000 employees.

All the plans I’ve described above are part of the biggest stimulus plan ever created by any government. That plan was also created in record time. So, we have an unprecedented large stimulus plan, that was created in record time with disregard to ‘conventional’ best practices. Cool.

I don’t know what will happen, but it is going to be interesting. As traders, we need to stay with the trend and make sure we are limiting our losses so we can stay in the game, even if the market turns against us. I’m sure that the market will adapt and find a new normal – the plan is to at least stay solvent till then.

If you’re looking for specific trade ideas, I’d look for selling OTM puts or puts spreads and will use the ‘include symbols’ list to limit the results to stocks that interest you. Click the button to start:

[…] few weeks ago I wrote about the actions the Fed is taking in order to stimulate the economy. If we look at the results, those […]

Great write-up! Think a lot of people lot money fighting the fed.

Thanks. I think it will be interesting to look into this series in a few years.