Mastering options trading can be challenging, but a systematic approach using a trading journal can significantly ease the journey. This article will detail the process of maintaining an options trading journal, its many benefits, and the crucial data to record. We’ll also explore who should use a trade log and offer a brief overview of the Options Samurai’s trading journal feature. Built by a team of experienced traders, Option Samurai provides powerful tools and insightful analytics that make trade logging and analysis efficient and effective.

Key takeaways

- An options trading journal is an important part of the process of successful trading. It allows you to take control of your trading, improve it, and find your edge

- The journal keeps track of your trades and their outcome. This allows you to learn based on facts and not emotions and biases.

- Consistently logging trades allows traders to identify emerging patterns, gain statistical insights, and refine their strategies accordingly.

In the world of options trading, the wisdom of “Measure twice, cut once” transforms from a simple adage to an indispensable strategy. It’s the practice of meticulously logging each trade – a preemptive measure that saves you from future pitfalls. Just as a carpenter relies on precise measurements, a trader’s log is their blueprint for long-term success.

Keeping a detailed trading journal serves as a valuable feedback tool in your quest to become a better, more consistent, and highly profitable options trader. Unfortunately, many options traders overlook the essential practice of logging their trades. The reasons can range from time constraints to not recognizing the value of a trading journal.

Others struggle to find a reliable and user-friendly tool. That’s where Option Samurai steps in. The platform takes the complexity out of logging trades, making it easy to track, analyze, and refine your strategy. Tools aside, if you don’t take time to log and reflect on your trading history, you’ll miss crucial insights that could prevent future losses or clue you into more profits.

Too many options traders overlook the importance of maintaining a trade log, whether due to time restrictions, underestimating its significance, or not finding a dependable tool. Today, you’ll learn how to overcome trading journal barriers. We’ll simplify the process and help you find the best tools that enable seamless tracking, analysis, and refinement of your trading strategy.

Options Trading Journal Basics

Conceptually, a trading journal is simply a record of all trades you execute. It’s a single source of truth for all trades, including details like entry date, strike price, strategy, and overall market conditions. You’ll be able to see your wins, losses, and even thoughts and emotions you went through before, during, and after the trade.

An options trading journal will also help you analyze profit and loss (P&L), and you’ll be able to see how your P&L correlates with both short and long-term market trends. Another key use of options journals is tracking open positions at a glance along with the broader context of each trade.

With time, an options trade log will help you better identify patterns in your trading activities and allow you to pinpoint better what’s working and what’s not. How your trading journal is set up will depend on what works for you personally, in combination with certain fields that any trader should track.

Who Needs an Options Trade Log

Whether you’re a novice trader trying to navigate the complex — and sometimes volatile — world of options trading or a seasoned professional looking to refine your strategy, maintaining a comprehensive trading journal is critical to success. When you’re just starting, you might overlook the immediate value of a journal, but over time, your efforts will compound.

The more trades you log in your journal, the more you’ll start recognizing insightful patterns to hone your strategy and considerably accelerate your overall learning process. Commitment to keeping a trade log serves not only to keep you accountable but also fosters purposeful, deeper learning about your trades.

It’s a common misconception to think you should only start a log once you’re consistently profitable. In reality, an informative trade log is a vital companion, paving the way toward steady profitability and consistent trading success. But starting a record early on, regardless of profitability, sets the foundation for stable profitability and consistent trading success.

The Benefits of Maintaining Your Trading Journal

Trading, often a solitary pursuit, is prone to emotional biases like fear and greed. A trading journal replaces feelings with fact-based evidence, providing a balanced perspective on past successes or failures and preventing impulsive decision-making. It’s an essential tool to curb biases and unprofitable knee-jerk reactions.

A trading journal also helps pinpoint optimal market entries, trading times, and stop-loss setups. It also helps to tailor strategies to fit your risk profile and trading psychology. By analyzing past trades, you gain valuable insights into market behavior patterns, fostering a more profound understanding and enhancing future trade performance.

A trading journal is an excellent tool for risk management. Through it, you learn to spot profitable opportunities and walk away from the wrong ones. If you find it challenging to stick to a trading routine, the journal will help you stay organized and develop the mental and emotional discipline you need to succeed.

Using an options trading journal, traders can quickly and risk-free learn new strategies, like the Iron Condor or the Wheel, by documenting and evaluating their paper trades, thus simulating realistic market conditions without risking capital. By journaling paper trades, you can experiment with new systems and adjust in real-time without risking capital.

This is especially valuable in leveraged options trading, which can be risky. Employing a trading journal not only assists in tax filing but also doubles as a portfolio for helpful peer reviews. It’s an essential tool for versatile analysis of past and current data, enabling you to craft unique, evidence-based strategies.

Ultimately, maintaining a trading journal boosts your trading confidence and acumen by facilitating learning from past missteps.

Parts of an Options Trading Journal

Options trading, with its numerous variables, demands a systematic record-keeping practice. An Options Trading Journal serves this need, helping traders track, analyze, and improve their trading strategies. This guide explores the necessary fields to include in your journal for optimal results.

Fields for Trade Identification

Understanding and recalling why a particular trade caught your attention is crucial. Include these fields:

- Symbol: The code for the underlying asset.

- Option Type: Whether the option was a call, a put, or a combo order.

- Strategy: The chosen approach for entering the position.

- Notes: Any additional observations and insights that piqued your interest?

Fields for Trade Execution

To document the trade’s progression, we recommend these execution-specific fields:

- Entry and Exit Date: Capture the date and the exact time of the day.

- Entry and Exit Price: The price of the options contract at both entry and exit points.

- Position Size: The number of shares you purchased.

- Strike: The strike price of the contract.

- Expiry Date: The date the contract is set to expire.

Fields for Trade Evaluation

The post-trade analysis provides valuable learning and insights. Detail your outcomes with these fields:

- Profit or Loss: Capture the gains or losses from each trade.

- Market conditions: Note the broader market trends and events influencing your trade.

- Volatility: The implied volatility and Greeks at the time of entry.

- Objectives: Your target profit from initiating the trade.

- Feedback: Reflect on outcomes, missed opportunities, and areas of improvement.

Fields for Personal Reflection

Accounting for your mental and emotional state can unveil personal biases and reactions. Capture this with:

- Emotions: Jot down your emotional state before, during, and after the trade.

- Lessons Learned: Detail the key takeaways from the trading experience.

A detailed Options Trading Journal is an instrumental tool in a trader’s arsenal. By diligently documenting each trade’s multifaceted journey, you create a robust resource for analysis, learning, and strategy refinement, bringing you closer to sustained profitability in your options trading endeavors.

Options Trading Journal Best Practices

Keeping a trading journal depends on implementing specific best practices. These practices improve your journal’s effectiveness and help you derive maximum value from it.

Here’s a closer look:

1. Consistency: The Backbone of Effective Journaling

- Prioritize regular updates: Keep your journal updated with every trade, ensuring you capture fresh insights.

- Leverage tools you’re comfortable with: This could be screenshots, specific software, or even a simple spreadsheet. What matters is that you can consistently use it.

- Keep it simple: A straightforward approach helps maintain consistency over time, contributing to the accumulation of valuable data.

- Consistency is the most essential aspect. Even if you don’t keep all the data described above.

2. Structure: Enhancing Your Analysis Capabilities

- Implement a uniform data collection method: This assists with future trade analysis, even for trades you barely remember executing.

- Be detailed and organized: A well-structured log allows for efficient grouping and review of trades, revealing repeated patterns.

3. Flexibility: Catering to Your Unique Trading Approach

- Adapt your journal to your needs: Different trading systems may require varied information. Don’t be afraid to adjust your log accordingly.

- Modify as needed: Make changes as you progress, especially after analyzing past trades. Your journal should be a dynamic tool that evolves with your trading style.

Remember, the best practice for keeping a trading journal is to find a method that works best for you. Consistency, structure, and flexibility are three fundamental practices to keep in mind. However, the ultimate goal is to create a journal that adds value to your trading journey, helping you to be more intentional, mindful, and successful in your trading strategy.

Choosing the Ideal Platform for Your Trading Journal

Every trader has unique needs when it comes to maintaining a trading journal. From casual to sophisticated traders, the choice of platform can vary greatly. Here’s a guide to help you identify the best fit for your trading style.

Casual Traders: Opting for Simplicity

For those who trade occasionally, a simple method works best. A paper journal, notebook, or a basic note-taking app on your device will suffice. These mediums are convenient, easy to use, and require little to no setup.

- Flexible entry: Write or type in your trade information, thoughts, and reflections.

- Convenience: Carry your journal with you or access your notes app from anywhere.

- No tech skills required: Just pen and paper, or a straightforward digital note-taking tool.

Frequent Traders: Harnessing the Power of Spreadsheets

If trading is a regular part of your financial activities, consider a digital spreadsheet like Excel or Google Sheets. These platforms offer more organization, data analysis potential, and customization.

- Organized data: Structure your data for easy access and understanding.

- Customizable: Tailor columns and cells to your specific needs.

- Analytical capabilities: Built-in functions can analyze patterns, calculate profit/loss, etc.

Sophisticated Traders: Leveraging Dedicated Software

For advanced trading involving multiple options types and strategies, dedicated software like Option Samurai can be a game-changer. It offers high-level customization, deeper insights, and analytical tools.

- High customization: Fit your trading journal to complex trading scenarios.

- Advanced analytics: Harness the software’s power to decode intricate trading patterns.

- Integration: Use the Samurai Excel plugin to build a personalized trading journal.

Regardless of your trading activity level, consistency is vital. Choose a method that aligns with your trading habits and stick with it to reap the full benefits of a trading journal. Option Samurai is one of the most robust tools that cater to both new and experienced traders while accommodating a high variance of strategies.

Leveraging Option Samurai’s Trading

Option Samurai is your all-in-one trading platform, equipped with a powerful options trading journal that helps track of trades found on the platform and analyze market trends. Our advanced, user-friendly interface allows you to easily document and analyze your trades, saving you time and increasing the accuracy of your strategy evaluation.

Plus, Option Samurai’s robust analytics tools offer detailed insight into market trends, helping you make data-driven decisions. Here’s how using Option Samurai’s trading journal can give you an edge in the market:

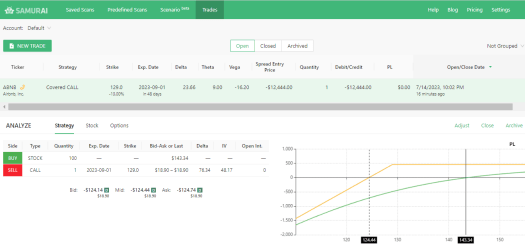

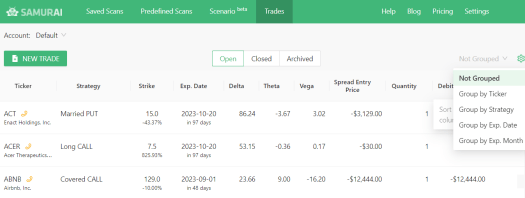

- You can directly add trades to the journal from our scanner or manually.

- The grouping feature categorizes trades according to expiration, strategy, ticker, and more factors. This reveals key trends, informing your future trading decisions.

- The trading journal is invaluable for monitoring open positions and testing new scans and strategies before implementation.

Trade Types in Option Samurai

Understanding your trades is crucial to improve strategy. Option Samurai organizes trading activities into three categories:

- Open trades: These give you a broad overview of your current options portfolio, showing details such as Greeks, P/L, and remaining intrinsic/extrinsic value.

- Closed trades: Analyzing these helps identify successful strategies and improves future trading decisions.

- Archived trades: These are ‘deleted’ trades that you wish to remove from your active view.

Consistency is Key in Options Trading.

Building and maintaining a trading journal requires consistency and discipline. But with the right tools, it’s a breeze. Opt for a platform that offers flexibility and comprehensive features, like Option Samurai, designed by experienced traders who understand the nuances of the trading world.

Embark on your journey towards successful trading with a two-week free trial at Option Samurai, and start gaining the insights you need for a competitive edge today.

This was beautiful Admin. Thank you for your reflections.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

very informative articles or reviews at this time.

There is definately a lot to find out about this subject. I like all the points you made

I appreciate you sharing this blog post. Thanks Again. Cool.

I just like the helpful information you provide in your articles

There is definately a lot to find out about this subject. I like all the points you made

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

There is definately a lot to find out about this subject. I like all the points you made