Today we will discuss one of the most popular strategies in options trading: iron condor. The Strategy became very popular due to the limited risk profile while maximizing the time value derived from selling options in both directions. Option Samurai scanner makes it easier to find relevant trades while applying this Strategy.

What is the Iron Condor strategy?

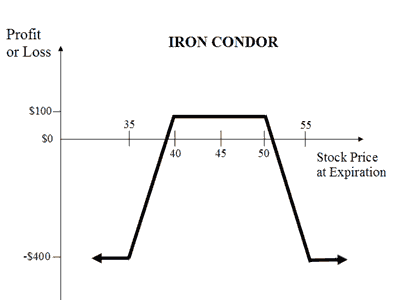

Iron condor can be described as selling a put spread and call spread (both OTM usually). Since this position can lose only on one side, it provides more premium per day compared to spread (this allows the trader to close the position early for profit).

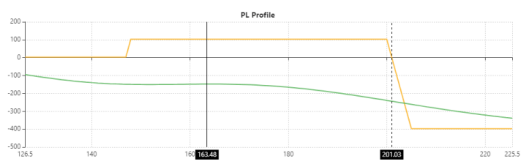

The Iron condor profit profile consists of limited profit and limited risk (the potential risk is usually greater than the potential profit). If the stock remains in the middle of the profit range, the seller will be profitable. If the stock breaches one side, the trader will lose. There is a great deal of adjusting trades we can do in these cases, but this is a topic for another article.

When to set up an iron condor?

Iron condor is a neutral strategy that profits from volatility decrease and the passage of time. Your goal is that the stock will expire in the ‘profit zone’ to keep the maximum profit, staying in the profit zone before expiration can lead to daily profit and you might consider taking the profits before expiration.

There is an edge in setting up an IC in a high IV environment (IV rank >80) where there is a greater chance of a volatility decrease. Another good practice is to sell the options on the other side of support and resistance level, to allow for more security in the position.

How to set up an Iron Condor?

When initiating an IC position we need to consider many variables, chief among them are the distance of the sold call and put options (can be different) and the ‘width of the wing’ – meaning the distance of the protecting option from the sold option. There are two main ways to set up an iron condor, but because it is hard for traders to optimize IC with 4 different parameters, both ways are sub-optimal:

- Vanilla (static) Iron Condors

- Dynamic Iron Condors

- Riskless Up/Down Iron Condors

Vanilla Iron Condor

The most common way to start using Iron Condors is by using a vanilla Iron condor. This IC is usually symmetrical on the calls side and on the puts side. This leads to similar maximum risk on either side and usually, the break-even point is the same distance on both sides.

An example of this can be:

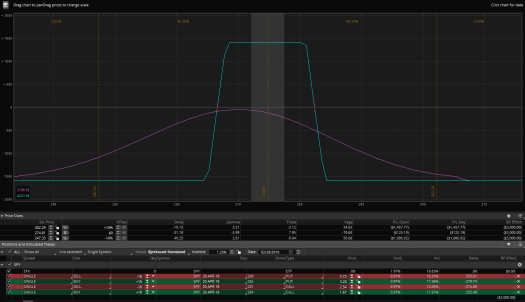

This is an example of Iron condor on SPY:

- The current price is $274.5

- We can sell 268 put and 281 call (7 strikes away (from 275/274 strikes)

- We will buy 265 put and 284 call (3 strike risk)

As you can see – The result is symmetrical with the same risk on both sides, and the current stock price is in the middle of the profit zone. Even so, You can see that the aggregated delta of this position is negative (-30) so at the moment we will profit from a decrease in stock price.

Static ICs have many disadvantages mainly due to the fact that they don’t take into consideration option pricing, market timing, skew, and other parameters.

Dynamic Iron Condor

Dynamic Iron condors are iron condors that are built with taking into consideration the options pricing such as skew, IV, and more. When traders set them up they usually use the delta of the options to choose which strikes to sell and buy. This leads to a predictable delta of the overall IC (usually around 0) and takes into consideration the options skew, IV, and probability implied by the market.

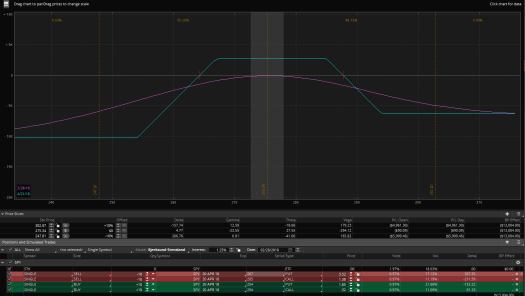

For example, if we build a dynamic IC on SPY where we sell the 30 delta options and buy the 15 delta options, it would look something like that:

In this example, when we sold the 30 delta options and bought the 15 delta options:

- The current price is 275.34

- On the call side, we sold the 285 strike and bought the 294 strike – Giving us 10 strikes distance and 9 strikes width.

- On the put side, we sold the 267 strike and bought the 254 strike – Giving us 8 strikes distance and 13 strikes width.

We can see that the IC is NOT symmetrical, there is more risk to the downside – both in total $ risked and in the distance. However, we can see that the delta is 4.77 (almost 0).

The dynamic IC is an improvement over the static IC as it takes into consideration the option pricing. We can improve it by optimizing the options, and not just picking deltas as a rule of thumb.

Riskless Iron Condor

You can also create a riskless Iron condor that will be riskless on the upside or downside. This is because the premium you collect from both legs is higher than the distance between the sold leg and the protective leg on one side.

Riskless Up Iron condor:

Riskless Down Iron Condor:

The benefit of these IC is that you have a directional bet in addition to the high premium you collect. This means that you only need to manage losses on one side, increasing the probability of profit considerably.

When using these iron condors, be mindful of the market and asset trends. Since we are usually in a bullish trend, Riskless up Iron Condors can provide a significant edge when trading (so use the ‘shape’ filter in Option Samurai to find those trades).

Optimized Iron condor – A better way to trade Iron Condors

As mentioned above, it is impossible to optimize IC without a dedicated program. There are too many parameters to control: Implied volatility, Skew, time to expiration, stock volatility the distance and price of 4 options, and more.

This is why we designed our Iron condor to check all possible combinations of Iron condor, and pick the best among them. We maximize the Expected Value in our calculations.

As a reminder: Expected Value is a statistical measure that tries to predict the value of the strategy, assuming you could have executed it many times at different dates but with the same prices/distances, etc. It is calculated by summing the payout at expiration multiplied by the probability of that payout.

When we maximize the Iron condor’s expected value we take into consideration the Implied volatility smile, the stock volatility, time to expiration, pricing, and more. This solves the disadvantages of the previous ways to set up ICs: It takes into consideration the individual situation of each stock and gives tailored IC for each stock.

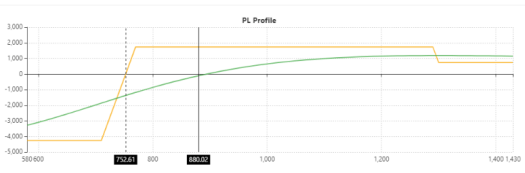

Let’s Check the following example:

In the above example we can see that the system recommended the Mar 23rd Iron condor with the strikes 165/167.5/195/197.5:

- Max profit $111

- The risk is 139$.

- Days to expiration is 23 days.

- Profit ratio is 80.5% (in 23 days – About 1260% annualized)

- Probability of max profit about 69%

- The expected value is $104.2

We can also see that the sold strikes are after major key support and resistance lines.

To see why it is better let’s test several variations:

- Wider wings: We can buy protection further than the original Idea. This will increase the premium collected, but would also increase the risk. In our case, it will add about $18 in premium (using mid prices) but will double the risk. So the profit ratio will be around 38% (much lower than the original 80%), and the expected value will be lower.

- Sell options one strike down: Selling further options reduces the probability of crossing the profit zone but also reduces the net premium collected. In our case, the probability of profit increase is about 10%, which is about a raise of 15% compared to the original probability of profit. On the other hand, the reduced premium is 80% less. So the expected value is much lower compared to the original trade.

- Change expiration: What about keeping the same strikes, but choosing another expiration? If we pick closer expiration we enjoy from higher probability of profit, but lower premiums, and the opposite if we pick further expiration: The premium will be higher, but the probability of profit will decrease. In our case, the positive effect has a lower percentage change than the negative effect in both expiration date before and after the 23 of Mar, this lowers the expected value and from a mathematical standpoint, the edge is lower.

To summarize – from a mathematical perspective – the suggested Iron condor is the best and provides the best combination of profit, risk, and probability of profit. It doesn’t mean that we shouldn’t make changes (in strikes or expiration), sometimes we want to take less risk or prioritize different expiration due to liquidity or periodic buying/selling pressure. However, it is important to be aware of the trade-offs.

Tips to find Iron condor in Option Samurai:

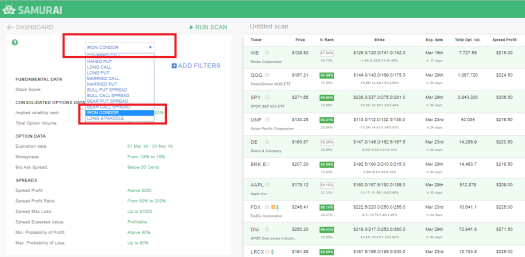

To find optimal IC in Option Samurai you can go to our Iron Condor scanner

Our scanner checks all possible iron condor combinations for all stocks that fit the criteria and shows you the best Iron condor for each stock for your consideration. We take those results and analyze them further to find the best trades.

Some tips to increase the number of good trades:

- Add ATR to upper breakeven and ATR to lower breakeven – ATR (Average True Range) is a volatility measure and can help us find trades where the break-even point is further than a threshold. Read more in this article. (We usually set the default at more than 2 ATR)

- Implied Volatility is mean-reverting and can increase your profits and even allow you to close trades early. Using the IV percentile will help you. Read about the backtest we did below.

- Use the bid/ask level filter – Iron condor is built by using 4 different options. By default, we are using the mid-price of each option to calculate the stats. Some stocks have a wide bid/ask spread so use the bidask level settings to use the conservative pricing (buying on ask, selling on bid) or 25% price improvement to improve your chances of being filled.

- Customize the spread profit, moneyness, expiration date, and max loss to better suit your trading style.

- You can loosen the profit filter, remove the upper limit from the profit ratio filter, and loosen the max loss filter to see more results and pick it up from there.

Check out the scanner here to start your free trial:

Some popular articles to help you:

- Implied volatility backtesting to help you increase your edge

- Realized volatility backtesting and how to use it

- Build an optimal vertical spread

- What is the Expected value and how to use it?

- Iron condor article in the knowledge base to help you understand the filters and options

[Originally posted on Mar 1st, 2018, and updated since]

To set up this strategy..

1. In wich level of iV rank you prefer to work with it?

2. Do you prefer to use stocks or etf?

3. Wich stock are your favorites for work this strategy?

This changes with the market conditions. I can tell you that lately I mainly sell puts/ put-spreads and I rather buy the call side,, then sell it (worked well). I usually wait for a stock to be oversold (for example RSI under 30) and near support before I initiate it. The reason is that it it is a directional play and my view is that those will be better in this market.

I think you can use the unique setups – of riskless up / down to better manifest your outlook.

Anyway – for me if we are talking about Iron condors I rater play heavy names so it can be large-cap stocks and ETFs. I also almost don’t play before earnings as I want to reduce the chance the stock will run away,

Anyway – The idea is to see what the market does and change what you are looking for.