This is a long thesis for WFC TARP warrants. Wells Fargo bank ($WFC) is one of the best banks trading in the US. It is also one of Warren Buffett’s largest holding, and he said numerous times how he respects the management and likes the company.

The financial crisis of 2008 is still affecting the banking sectors in large, and WFC in particular. The negative effect is both in investors sentiment and on going legislation and law suits filed against the large banks (mainly JPM, but not solely). These negative effects can be used by investors who think differently than the markets. One of the biggest effect that are open to exploits are the TARP warrants issued by the banks. Those warrants offer leverage on long positions on the financial institutions and if chosen correctly, can increase the investor profit without increasing the risk as much.

Before talking about the warrant, let’s talk about the stock:

$WFC Does not need to much introduction as it’s one of the leading banks in the US. $WFC survived the market crisis and gained even more power afterwards. That fact didn’t escape the market players and we can see that $WFC is in a clear bullish trend and reaching new highs:

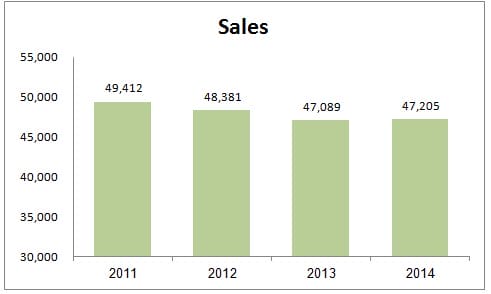

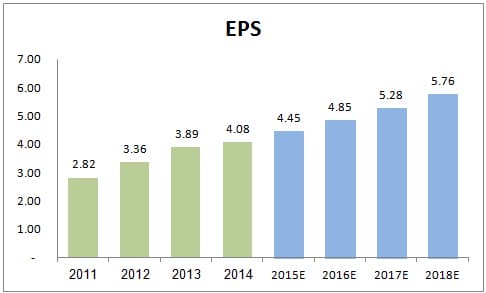

The stock price is rising as the bank fundamental are improving. Though sales have stagnated, the company EPS is rising fast (13% since 2011)

The above charts show that WFC manged to increase its profitability even though sales have decreased. The blue bars in the EPS charts are projection of the EPS, assuming 9% growth rate.

WFC TARP Warrants

The Warrant on WFC is a long-term call option on WFC. The mechanism is simple: You can buy the WFC warrant in the open market (Quote) and then, by Oct 2018, you can exercise it: you can pay the strike price and receive the stock. IMPORTANT NOTE: If you don’t – the warrant will expire worthless! so either sell it or exercise it. The current warrant strike is 34.01 and stock price is around 52~ so the option is deep in the money. What are the benefits of holding the warrant over the stock:

- Leverage – Since the strike is 34.01$, the warrant is traded for about 20$, compared with 52$ of the stock price. A move of 1% in WFC will change 52 Cents. Since the option is in the money it will also rise about 52 cents. but this move represents a higher percentage move – 2.6% (0.52/20) . This means that you can gain about 2.5 leverage on the position, with very long option.

- Dividend adjusted – If WFC distributes a dividend higher than 34 cents (currently 35 cents) then the strike price will be adjusted accordingly. This will lower the strike (the price we pay at expiration) and in essence – acts as a “tax efficient” position.

Valuation of WFC warrants

I have done a quick and dirty model to evaluate the future value of WFC and the warrant. I will explain that model below so it will be easy for you to input your own assumptions and understand the future value.

My assumptions:

- 2014 EPS 4.08 (TTM)

- EPS growth – 9% – Similar to analyst prediction and less than recent history

- PE in 2018 – 12.5 (compare to 12.9 today and 11.4 the average low PE)

- Average dividends for the next years – 1.5$ – compare with 1.4$ current rate.

Under these assumptions, the warrant should be worth about 42.48$ (and stock about 72$) in 2018. Compare with current price of 19.69$ – This is a 115% increase.

Summary

The Pro:

- Good bank with considerable upside and relatively low downside (won’t go to 0)

- Leverage position allows you to risk less capital and still have the same upside potential.

- Dividend adjustments allow you to enjoy the dividend and differ the tax.

- If the bank continue to perform as it did – 115%+ upside.

The cons:

- Regulations, legislation and law suits might hurt the bank

- Leverage is a double edge sward. Remember that If WFC will trade under the strike the warrant will be worth 0.

The model

I’ve added the excel model where you can add your own assumptions and see how it affects the pricing. You should only edit the orange cells – They will affect the calculations and won’t destroy the formulas.

Download the model here: OptionSamurai-WFC Model