Predicting stock movements is the holy grail of investors, and many studies, tests, and systems have been developed and are being developed to do so. Four professors from Columbia, Georgetown, and Fordham universities wrote a paper with the sexy name: “The joint cross-section of stocks and options”. In this article, they show that IV changes can predict stock market movements; specifically: An increase in call IV predicts a bullish move, and an increase in put IV predicts a bearish move (but less significant). The article, in it’s 135-pages-of-glory is available here: The Joint Cross Section of Stocks and Options

Here are the main takeaways:

- What did they find?

The researchers found that changes in IV can predict future stock movements. They created a delta-call and delta-put variables – calculated as the difference between this months call (put) IV and last month call (put) IV. They saw that, on average, the stocks with the highest delta-call outperformed stocks with the lowest delta-call. The results were not as strong for delta-put, probably due to the tendency to see those options as “insurance.”

- What is the data ?

The researchers conducted a comprehensive test including all optionable options from 1996-2011. On average they checked 1816 stocks yearly, where the universe size expanded from 1261 stocks in 1996, to 2312 stocks on 2011.

- The methodology:

The researchers organized all stocks to deciles every month and calculated the average subsequent month return for each decile. If we have a pattern we would be able to see that each decile will behave closer and closer to our predicted behavior.

- What is the Call Edge?

The highest delta call stocks outperform the lowest delta call stocks by 1.09% monthly (on average).

As we can see, each decile outperforms the decile before it, as we increase the average delta call (which is the change in call IV from the previous month)

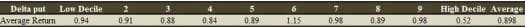

- What is the put Edge?

Judging by the call edge, we would expect that the highest delta put (the highest change in put IV month-over-month) will underperform the most when compared to the other deciles:

Looking at the different deciles, we see that the extreme deciles behave as expected, but middle deciles do not. This means that this edge is not robust enough to use.

- Can we improve those results?

The results look good, and the edge (for call options) looks robust, but this is a “large-scale” test. When trading the market, we can expect large IV increases that won’t necessarily cause stock outperformance. One of the most common examples: earning reports. Prior to earning reports, we will see a huge increase in IV. This DOES NOT mean that the stock will outperform. Actually, the rise is justified due to the increase in volatility. To address this, the researchers check Delta-put [minus] delta-call: This creates one variable that aggregates both, and adjusts the result if the increase is due to a general IV increase.

The deciles are opposite (low decile = outperform) due to the structure of the variable. We can see that combining those two variables increased the robustness of the result (both alpha measures and t-stat).

- Read more about our Implied Volatility Percentile and its edge in our complete guide.

Summary

This article describes the edge in measuring unusual increases in IV. Since IV can describe the market view on the underlying, the trends of this value contain data that we might use. The key takeaway is the table describing delta-put minus delta-call. This test was conducted to filter “regular” IV increases in both directions and leave us with unexplained (and maybe I should add “yet”) increases in one direction that may imply a future move.

- Read part 2 of this series: Trading Implied Volatility – Part 2

- Read about the backtests we did proving the edge of IV in this article: Implied Volatility backtest pt 3: IV and RV