Summary:

- The last earning call for IBM was terrible. Not only missing this year’s estimates but deviating from the 20$ EPS in the 2015 road map.

- IBM’s business is cyclical, and there are worries that business might get worse before getting better.

- Even so, I’m Long IBM since in current price, even with lower EPS, is cheap.

- Furthermore, the company has a stock buyback program and has a dividend yield of close to 3%.

After a terrible earning call – IBM got hammered and dropped more than 10% since before the earning call.

No doubt, the earnings were bad. Not only did the company miss its earning estimates for the quarter, but it also gave lower guidance for the year. This will be the company’s first decline since 2002. Furthermore, the management suggested fixes that are “more of the same”, which suggests things might get worse before getting better.

The worst announcement was the deviation from the EPS roadmap the management announced long ago: a 20$ EPS from 2015 onward. After the recent developments, the management said it will NOT achieve this goal and will give updated projections in Jan 2015.

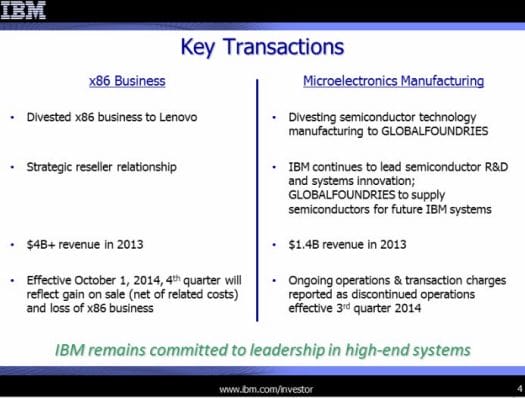

The management was open about their disappointment with the results and stressed their dedication to their strategic plan: to move to high-value (and profit margins) products and services. Recent examples are the Lenovo deal (servers) and the Global Foundries deal (Chips).

The management believes that those businesses need a lot of capital to grow but don’t return enough profit to justify the investments. Those deals will allow IBM to invest in other areas such as Watson, security, and more.

This is a sound decision, but we still need to see how it plays out. Specifically, since IT is a cyclical business and might show a downturn it will hurt IBM’s efforts anyway.

So why Long IBM?

- Management – I still didn’t lose faith in the management. Even though the results were bad, it is not uncommon to have a bad Q or year. I feel that the management was straightforward with the investors, and they see returning value to shareholders as a high priority.

- The stock is Cheap – even with recent declines, the projections for EPS for 2014 are above 16$. This means PE 10 with current market pricing. Even with a 10-20% EPS decline, the stock is still cheap.

- Shareholder Yield – The company has a solid dividend plan, that yields almost 3% (more than treasuries). But the biggest appeal is the buybacks: the company bought almost 10% of the float this year alone. Since 2008 the company bought over 30% of its shares. This presents a huge advantage and a “buffer” to protect from long-term loss of capital. (It is true that the company takes debt to maintain this high buyback rate, but debt is still sustainable; the company is still very profitable and even at a slower pace, which is a good thing.)

The Trade

You can find many potential trades using our options screener for IBM. In this case, I took a ratio spread for Jan 2015 – selling call 160 and buying 2 calls 170 for each option sold.

The trade has a positive Delta, allowing me to gain if the stock rises. However, if I’m really wrong and the stocks collapse, I’m still protected (if the price falls much below 160).

I bought the ratio spreads since I expect a large move, as the market re-evaluates the new data. I’m still looking for naked put selling to add to my position.

See other trades: