In simple terms, understanding the intrinsic value of an option is fundamental for traders. This guide will help you understand and memorize how to calculate the intrinsic value of a call option or put option by comparing the strike price with the current market price.

Key takeaways

- The intrinsic value of an option represents the value an option would have if you chose to exercise it today. You can determine an option’s intrinsic value by comparing its strike price with the underlying security’s current market price.

- OTM options have no intrinsic value, as they only have extrinsic or time value.

What Is an Option Intrinsic Value?

The intrinsic value of an option is a fundamental concept that every options trader needs to understand. In simple terms, it represents the profit that could be made if you were to exercise the option right away, based on current market conditions.

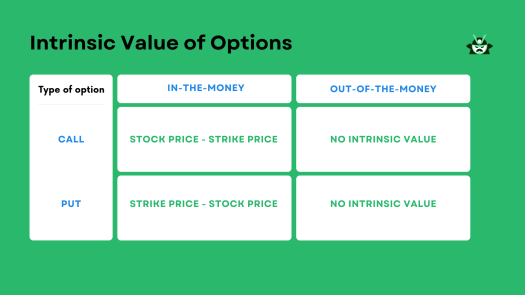

Calculating the intrinsic value of an option is straightforward. For a call option, you will take the current stock price minus the strike price. If the result is positive, that’s your option’s intrinsic value. On the other hand, when dealing with put options, you’ll take the strike price minus the current stock price. The difference reflects the intrinsic value of the put option.

In general, you will have a positive difference for both in-the-money (ITM) calls and puts. The negative difference you will obtain in the out-of-the-money (OTM) case simply indicates that OTM options have no intrinsic value.

So, let’s say you have a call option with a strike price of $50, and the current market price of the stock is $55. In this case, the intrinsic value of the call option is $5. This is because you have the opportunity to buy the stock at $50 and sell it immediately at $55, making a profit of $5 per share.

The same principle applies to put options. Suppose you have a put option with a strike price of $60, and the current market price is $55. The intrinsic value of the put option is $5 because you can sell the stock at a higher price ($60) than its current market value ($55).

But why is this important? Well, knowing how to calculate the intrinsic value of an option allows you to measure the potential profitability of an option. It helps you discern whether an option is in-the-money (profitable) or out-of-the-money (not profitable). That’s what makes understanding what is the intrinsic value in options so crucial.

However, while intrinsic value provides an immediate snapshot of an option’s potential profitability, it doesn’t paint the full picture. At the end of the article, we’ll take our time to treat the broader topic of option pricing, and we’ll take into account factors such as volatility and time.

With this in mind, let us share a quick snapshot below with the simple rules to follow to calculating the intrinsic value of options:

Calculating the Intrinsic Value of a Call Option

Let’s be a little bit more specific about computing the intrinsic value of a call option. It’s not as complex as it might sound.

Here’s how to calculate the intrinsic value of an option: If the current market price of the stock is higher than the strike price of the call option, the option has intrinsic value. To find this value, simply subtract the strike price from the stock’s current market price. So, if a call option has a strike price of $30 and the stock is trading at $34.80, the intrinsic value of the call option would be $4.80 ($34.80 – $30 = $4.80).

It’s crucial to understand the impact of ITM and OTM scenarios on the option intrinsic value (meaning that the option’s moneyness is an essential factor to consider in this case). ITM options (where the strike price is below the stock’s current market price for call options) have intrinsic value. This value contributes to the overall option premium.

On the other hand, OTM options (where the strike price is above the stock’s current market price for call options) do not have intrinsic value. Their premium is solely determined by extrinsic value, which is subject to time decay.

Computing the Intrinsic Value of a Put Option

After seeing the call case in the previous section, let’s now focus on understanding the intrinsic value of a put option. Remember: the intrinsic value of an option, be it call or put, is the amount by which it is profitable, or in-the-money, if exercised immediately.

For a put option, the calculation is slightly different than that of a call option. Here, you subtract the current stock price from the strike price. For instance, if a put option has a strike price of $50 and the stock price is currently at $45, the intrinsic value of the put option would be $5 ($50 – $45 = $5).

If you’re following our reasoning, you’ll understand that the intrinsic value comes into play when the put option is ITM, meaning the strike price is higher than the stock’s market price. In this scenario, the option holds an intrinsic value as it could be sold for more than its purchase price.

However, if the put option is OTM, where the strike price is lower than the stock’s market price, it has no intrinsic value. In such cases, just like we saw in the call case, the option’s premium is purely based on its extrinsic value.

Remember, knowing how to calculate the intrinsic value of an option is one of the keys to successful options trading.

What Is the Difference Between Intrinsic and Extrinsic Value?

We’ve mentioned the extrinsic value of an option a couple of times above, so it makes sense to spend a few words on this essential aspect for option traders.

Let’s remind ourselves what is the intrinsic value in options. The intrinsic value of an option reflects the immediate, tangible benefit of exercising the option now. It’s the actual cash profit that could be made from the exercise, based on the current market price of the underlying asset relative to the strike price.

Consider stock ABC, currently trading at $70 per share. A call option with a strike price of $65 has an intrinsic value of $5, as you could promptly exercise the option, purchase the shares for $65, and sell them for $70, making the $5 difference. If the strike price was $75, the option would have no intrinsic value as it wouldn’t be profitable to exercise it.

On the other hand, the extrinsic value of an option, also known as the time value, is the additional premium that traders are willing to pay for the possibility that the option may become profitable before expiration. It’s like betting on the future. This value decreases as the option nears its expiration date, a phenomenon known as time decay.

For example, if the same $65 call option on ABC stock is priced at $7 when the stock is trading at $70, it has an intrinsic value of $5 and an extrinsic value of $2. The extrinsic value represents the market’s guess on how much more valuable the option could become before it expires.

The same principles apply to put options. Let’s say ABC stock is trading at $50, and a put option with a strike price of $55 has an intrinsic value of $5. If this put option is priced at $7, it has an extrinsic value of $2.

Understanding the difference between intrinsic and extrinsic value is crucial for any trader. The intrinsic value of an option gives you an idea of what your immediate profit could be, whereas the extrinsic value helps you gauge the potential for future profit.

What Is the Relationship between Intrinsic Value and Time Value?

At this point, we have enough information to introduce this formula:

Time value = Option Premium – Intrinsic Value

This formula is a fundamental equation in options trading that clearly illustrates the relationship between intrinsic value and time value. The option premium, which is the price a buyer pays for an option, can be broken down into time value and intrinsic value.

As we explained, if the market price is favorable to either the call or put option, then the option has intrinsic value.

On the other hand, time value represents the additional worth that traders assign to an option based on the potential for it to become profitable before its expiration date.

For instance, consider a call option on a stock that is trading at $20 with a strike price of $15. If the option premium is $7, the intrinsic value would be $5 (the difference between the stock price and the strike price). The remaining $2 of the premium is the time value, calculated using our formula: $7 (option premium) – $5 (intrinsic value).

As the expiration date approaches, the time value decreases due to the diminishing likelihood of the option becoming more profitable, a phenomenon known as time decay. Consequently, as an option nears expiry, intrinsic value becomes the primary component of the option’s price if it’s in-the-money.

You should aim to learn how intrinsic value and time value interrelate and perform this analysis in only a few seconds, as this is an invaluable helper for options traders. It helps them assess the risk and potential return of an option, guiding a trader’s decision-making process.

If you don’t know how to calculate the intrinsic value of an option and do not understand the impact of time value, you may be losing out on fully understanding the “bigger picture” when trading options. If you consider both intrinsic and time value, you can evaluate the true worth of an option and make trading decisions that align with your financial goals.

Factors Influencing an Option Premium – The Black & Scholes Model

If we move a little bit beyond the intrinsic value of an option, understanding the variables that influence the option premium is crucial, especially considering that we have hinted at the topic in several passages above. Specifically, you will want to get familiar with the Black & Scholes model or, even better, with its components.

Underlying Price

The underlying price of a stock directly influences the option premium. As the stock price increases, the intrinsic value of a call option rises, leading to a higher premium. Conversely, as the stock price decreases, the intrinsic value of a put option increases, causing its premium to rise. Understanding this relationship can help traders predict how changes in the stock price might affect their potential profits or losses.

Strike

The strike price is the predetermined price at which the option can be exercised. It’s instrumental in determining the option’s intrinsic value. If the strike price is less than the stock’s current market price for a call option, or more than the stock’s current market price for a put option, the option has intrinsic value. This means it’s in-the-money and contributes to the option premium. If the opposite is true, the option is out-of-the-money and has no intrinsic value, reducing the premium.

Time Until Expiration

Time until expiration significantly impacts an option’s premium. As the expiration date approaches, the option’s time value decreases due to time decay. This reduction in time value means there’s less opportunity for the option to become in-the-money, thereby decreasing the premium. Understanding the impact of time decay on options premiums can help traders optimize their trading strategies.

Implied Volatility

Implied volatility reflects the market’s expectations for future price fluctuations of the underlying stock. A higher implied volatility suggests a greater likelihood of substantial price movements, leading to higher option premiums. Conversely, lower implied volatility results in lower premiums. If you understand this relationship you can use it to assess the risk associated with an option.

Dividends

Dividends paid by the underlying stock can affect the option premium. When a stock pays a dividend, its price typically decreases by the dividend amount. This reduction in stock price impacts the intrinsic value of an option and, in turn, affects the premium. For call options, a dividend payment usually results in a lower premium, while for put options, it often leads to a higher premium.

Interest Rate

The prevailing interest rate also plays a role in determining option premiums. Higher interest rates increase the cost of holding the underlying stock, which can lead to higher option premiums. Conversely, lower interest rates decrease the cost of carrying the stock, potentially resulting in lower premiums.

Therefore, understanding these factors and their influence on an option’s premium is vital for any trader. It goes beyond knowing how to calculate the intrinsic value of an option and delves into the intricacies of options pricing. By considering the underlying price, strike price, time until expiration, implied volatility, dividends, and interest rate, traders can more accurately assess the true value of an option.

Practical Examples of Intrinsic Value Calculation in Various Market Conditions

Before wrapping up, it makes sense to take a look at two cases with live market data to demonstrate how the intrinsic value of an option plays out in different market conditions.

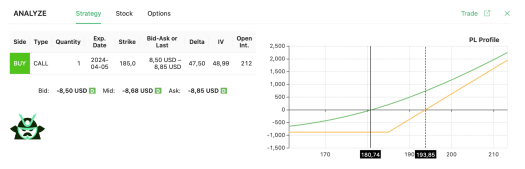

Let’s consider a call option on Tesla (TSLA) that’s currently trading at $180.74. We’ll look at two options with different strike prices but the same expiration date.

Case 1: ITM Call on TSLA

The first case we can find on our options screener has a strike price of $170, and its bid-ask prices are quoted at $16.60-$17.20.

To calculate the intrinsic value, we subtract the strike price from the stock price: $180.74 – $170 = $10.74. This is the option’s intrinsic value. The remaining portion of the premium (roughly $6 at the midpoint of the bid-ask spread) is the extrinsic value, subject to time decay.

Case 2: OTM Call on TSLA

Now, let’s look at a call option on TSLA with a strike price of $185. This option is currently out-of-the-money. Its bid-ask prices are quoted at $8.5-$8.85.

In this case, the option has no intrinsic value because the stock price is below the strike price. The entire premium reflects the extrinsic value.

To summarize what is the intrinsic value in options, memorize these formulas:

- For ITM call options: Intrinsic value = Stock price – Strike price

- For ITM put options: Intrinsic value = Strike price – Stock price

- For any OTM options: Intrinsic value = 0

Understanding what is the intrinsic value in options helps traders assess the profitability of an option. It provides a clear view of the immediate financial benefit if the option were exercised today, making it a significant factor in the decision-making process.