This is a quick post on how I find dividend capture opportunities in the stock market. As part of my weekly process, I like to look for dividend stocks that distribute dividends in the next month (up to a month and a half usually). I put them on a watch list and then look for a buying opportunity.

As a reminder – Dividend capture is a process of buying 100 shares and selling one call on stocks before their Ex-date. This allows us to have 2 outcomes:

- The stock will be called away before the dividend – in this case, I get the return and hold the position for less time.

- I will get both divided and the call option premium – and will get 2 income streams in a short period of time.

Here is a quick GIF of the process:

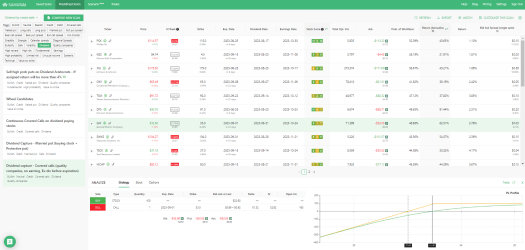

As you can see, it’s really easy: I chose the pre-defined screen (dividend capture) and then filtered the stock score some more.

You can check a trade I did here: Dividend Yield on Strike – $KO trade

If you want to scan manually for dividend capture opportunities, The parameters are:

- At the money – out the money calls.

- The expiration date is up to a month and a half from today.

- The stock score is good

- annualized return – 10% or more

- Open interest – 1000 or more

- Earning release after expiration

- dividends before expiration

After I get the list, I take out any sector or stock I don’t like (or have enough exposure to), and if the implied volatility is too low or the dividend yield is too low, I will skip that as well.

Here is an example results page. You can get the most up-to-date results in our options screener (free access, no credit card required):

Read the summary we did about Profiting from dividends with options.