As Q3 earnings commence, U.S. stocks are hitting all-time highs, as low interest rates and the promise of deregulation and tax cuts are buoying riskier assets. If you think stock prices will continue to remain buoyed but don’t want to purchase shares ahead of earnings season, a great way to generate a position is by using a vertical option credit spread.

Vertical Credit Spreads

A vertical option spread strategy is one where you purchase and sell two alike options (either 2-puts or 2-calls) simultaneously, that have the same expiration date. The only difference between the options will be the strike price and the premium. A vertical option that is a credit spread allows the seller of the spread to receive a credit, which means the premium of the option you sell is higher than the premium of the option you purchase. For example, a vertical bull put credit spread would consist of:

Sell PUT XYZ $50 November 17, 2017 ($1.00)

Buy PUT XYZ $45 November 17, 2017 ($0.25)

Net Premium $0.75 per contract

When you sell a vertical put spread you are selling the higher put and purchasing the lower put and receiving a credit. When you sell a vertical call spread you are selling the lower call and purchasing the higher call receiving a credit. The benefit of selling a bull put credit spread is the price of the underlying stock does not need to rise, it just needs to stay above the sold put strike price until the expiration date for you to receive the entire premium.

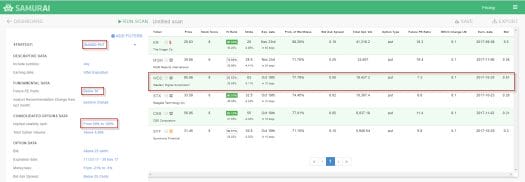

Running an Option Samurai Scan

There are several criteria that are key to finding a robust vertical credit spread.

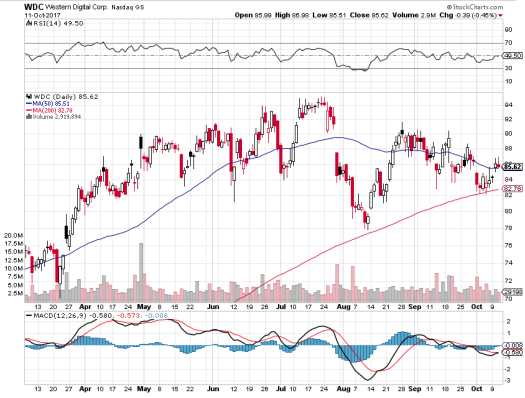

Western Digital Corp ($WDC) has been chopping around in a relatively tight range ahead of its earnings which are scheduled to be released on October 25, 2017. Support is seen near the 50-day moving average at $85.62 and then again at the 200-day moving average at $83.00. To find a bull put spread using Option Samurai, scan for an attractive naked put. You can then protect the naked put with a purchase of a lower strike put, to form your bullish put spread.

The Option Samurai Scan can include any symbol, where the earnings date of the underlying stock is after the expiration of the option. This will eliminate unwanted volatility. You also want to find a stock that has a PE ratio that is below 30, so you are not getting stocks that do not have any earnings (In this case WDC has Future PE of 7.3 which makes it very cheap in Analyst eyes.

Additionally, stocks were analysts have recently upgraded their recommendation in the last month, means that expectations for earnings momentum is on the rise. You can do this by making the Analyst Recommendation Change from last month positive.

You also want to make sure that the implied volatility that is priced into the short option (which is the naked put), is in the upper half of its 52-week range. You can do this by making the implied volatility range in between 50% and 100%. You want the bid of the option to be at least $0.50, since you will have to purchase a protective put and want the premium to be at least $0.25. When you sell a bull put credit spread you want the naked put to be an out of the money put. You can accomplish this by making the moneyness -3% to -21%. Lastly, you want the bid-offer spread to be relatively tight and less than $0.25.

$WDC Bull Put Spread Trade

- Sell WDC October 20, 2017 $83.0 Put at $0.60

- Buy WDC October 20, 2017 $81.5 Put at $0.33 (You can buy a cheaper protection, but then the maximum loss is greater, for example Strike $80 Put at $0.16)

Your potential gain on the trade is $0.27 ($0.44 for the riskier trade). You broker will request margin of #contracts * 100 * ($83 – 81.5 + $0.27) or $123 per contract ($256 for riskier trade). Your return if both options expire worthless is 22% ($27/$123) – or 17% for the riskier trade.

Your maximum loss is the different between the 2-strike prices ($1.5) minus the premium, = $1.23 or $123 per contract (vs $256).