Options traders, from beginners to seasoned veterans, seek a methodical approach that delivers consistent income while managing risk. This is where the Wheel Strategy, which involves selling puts against stocks, truly shines. Implemented correctly, the Wheel Strategy provides a dependable route to recurring profits regardless of a trader’s experience level.

To understand the Wheel Strategy, one must not only grasp its mechanics but also recognize its potential and know when to employ it. Whether you’re a veteran in the market or just starting your investment journey, the Wheel Strategy can provide a reliable method for optimizing returns in varying market conditions.

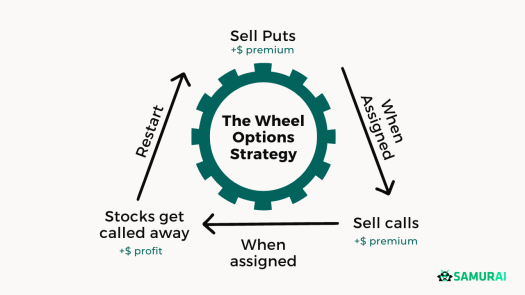

The Wheel Strategy is not merely a term but a cyclical process, reflecting the perpetual motion of a wheel. It comprises an ongoing sequence of steps aimed at generating regular income and profits. Paired with potent tools like Option Samurai, the Wheel Strategy can become a cornerstone of your trading strategy.

In the following sections, we will delve deeper into its nuances, empowering you to navigate the options market with greater confidence and precision.

Why the Wheel Strategy Works: Understanding the Edge

The success of the Wheel Strategy rests on several fundamental aspects of market behavior and options trading principles. In essence, the Wheel Strategy taps into time decay, price movement, and market sentiment to extract profit consistently.

Bullish Bias

Historically, markets tend to be bullish over time. This trend favors the Wheel Strategy, a mildly bullish approach that’s ideal for steady, long-term growth. The Wheel Strategy is designed to generate income in most market scenarios, making it an invaluable, versatile tool in any trader’s toolbox.

High Probability of Profit from Selling Options

Selling options, central to the Wheel Strategy, has a high-profit likelihood due to the time premium in options prices. The premium decays over time, favoring sellers who profit “unless” a specific event occurs, unlike buyers who profit “only if” an event happens. Also, the Wheel strategy uses ‘covered’ positions: Covered Calls or Cash Secured Puts, so they are less risky from uncovered strategies, such as naked call selling, for example.

Time Decay and Stock Price Stability

The Wheel Strategy profits not only from time decay but also from stability in the stock price. If the stock price remains the same or rises, the strategy continues to generate income. This is because both selling puts and calls bring in premiums, regardless of whether the options are eventually exercised.

Overpriced Options

Another dimension of the Wheel Strategy’s edge is its capacity to exploit overpriced options. High implied volatility often leads to inflated options prices. Selling these options means receiving a larger premium, which in turn enhances potential profits. This dynamic adds a strategic edge to the Wheel Strategy. Research shows that options prices are often over-priced, and this strategy takes advantage of it.

Dividend Income

If you end up owning a dividend-paying stock through the Wheel Strategy, you stand to gain an additional stream of income. While not the main focus of the strategy, dividends are a pleasant bonus that can contribute to overall returns. As a form of passive income, dividends also help reduce overall portfolio volatility, amplifying the benefits of the Wheel Strategy.

Anticipating Stock Price Increase

Lastly, the Wheel Strategy can profit from an eventual increase in the stock price, assuming the underlying asset is consistently profitable. This assumption aligns with the strategy’s mild bullish bias and the trader’s comfort with owning the stock.

In summary, the Wheel Strategy leverages several market mechanisms to offer a consistent and high-probability income strategy, making it a viable choice for those seeking an edge in the options trading market.

Implementing the Wheel Strategy: Step by Step

Embarking on the Wheel Strategy journey requires an understanding of the precise steps involved. This section will guide you through the process, illuminating how to select a suitable stock, sell cash-secured puts and covered calls, collect premiums, and manage assignments, all while keeping risk mitigation at the forefront.

Step 1: Choosing the Right Stock

Begin the Wheel Strategy by selecting a stock you’re comfortable owning long-term. Look for stability, profitability, growth, and dividends. It should align with your overall investment strategy and, ideally diversify your portfolio.

Ensure the stock has high options liquidity, indicating robust trading activity. This promotes tighter bid-ask spreads, more equitable pricing, and increased position management flexibility, enhancing the strategy’s efficacy. Set scanner filters for total options volume exceeding 5000 and a bid/ask spread under 0.5 to improve selection.

Leverage an options screening tool like Option Samurai to elevate accuracy and profitability in identifying suitable stocks for the Wheel strategy.

Step 2: Sell a Cash-Secured Put

Having identified a suitable stock, the next step is to sell an out-of-the-money (OTM) put option. Choose a strike price at a level you’re comfortable buying the stock. Selling a cash-secured put means you need sufficient cash in your account to purchase the stock if the option gets assigned.

The cash-secured aspect of this strategy minimizes risk, ensuring you have the necessary funds to meet your obligations if the stock’s price falls below the strike price. This put-selling process introduces you to the initial income-generating part of the Wheel Strategy.

Step 3: Collect the Premium

Upon selling the put option, you’ll receive a premium – a direct income that you retain, regardless of future events. This premium compensates for your accepted obligation to buy the stock later potentially.

Collecting premiums provides immediate cash flow, contributing to the Wheel Strategy’s appeal. As each transaction unfolds, these premiums can significantly reduce your overall investment cost basis, supporting your income generation and risk management objectives.

Step 4: Wait Until the Expiration

With your sold put in the market, you’ll now observe the stock’s price. Time is in your favor. If it remains above the strike price at expiration, your option expires worthless. You retain the premium and can sell another put.

However, if the stock’s price falls below the strike price, you’ll need to buy the stock at the strike price, which may be higher than the current market price. This assignment should align with your initial intent: owning a stock you’re comfortable with.

There is a third option – to roll the put option for additional credit, but this depends on the market conditions and is outside the scope of this article. If there are requests for that, we will write some tips for that.

Step 5: Sell a Covered Call

If assigned the stock, your next move is selling a covered call, ideally at or above your purchase price. Here, you’re selling the right for someone else to buy your stock at a specified strike price.

The covered call step offers another layer of income. However, should the stock’s price exceed the call’s strike, you’ll sell the stock at the sold strike price (That is why you should aim to sell above the bought price – to guarantee profit from the sale).

Step 6: Collect the Premium and Dividends:

Selling the covered call nets you another premium, which you retain, further reducing your stock cost basis. If the stock pays dividends, you’ll collect these too, enhancing your earnings while owning the stock.

These earnings components—premiums and dividends—combine to create consistent income, one of the Wheel Strategy’s compelling features. This income can mitigate potential price declines, contributing to a well-balanced risk-return profile.

Additionally, assuming the stock doesn’t go to 0, the more time you hold the stock, the more dividends and premiums you collect -> so time works in your favor.

Step 7: Repeat the Process

The Wheel Strategy’s beauty lies in its repeatability. Whether your put or call expires worthless, or your shares are called away, the process begins anew with selling another cash-secured put.

Repetition is key in the Wheel Strategy, with each cycle presenting opportunities for income and, potentially, profitable stock ownership. The iterative nature of this strategy provides a structured approach to options trading, promoting disciplined execution and risk management.

Avoiding Hazards: Risk Management in the Wheel Strategy

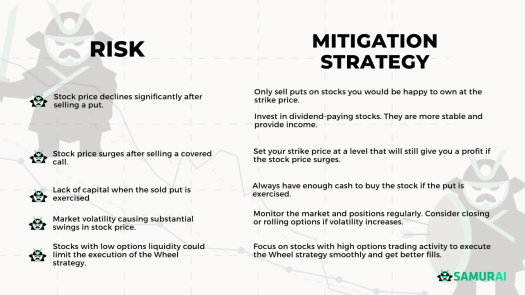

The Wheel Strategy is not immune to risks, most notably stock price fluctuations. If the stock price drops significantly, you could end up owning the stock at a higher price than the market price. Moreover, if the stock price skyrockets, you might miss out on potential profits because your shares might be called away.

Mitigating these risks involves a deep understanding of the underlying stock and the market conditions. Be prepared to own the stock at the strike price of the put option, and make peace with possibly losing out on extra profits if the stock price exceeds the call option strike price.

To safeguard profits, choose stocks you’re confident about, and use conservative strike prices. Diversifying your Wheel Strategy portfolio can also reduce the risk of major losses. Finally, staying vigilant, monitoring market trends, and adapting your strategy to changing conditions are crucial for minimizing risks and maximizing profits.

- Risk: Stock price declines significantly after selling a put.

- Mitigation Strategy: Only sell puts on stocks you would be happy to own at the strike price. This way, if the stock price drops and the put is exercised, you acquire a stock you are confident will rebound.

- Favor dividend-paying stocks – Companies that distribute dividends are usually more stable, and the dividend income helps reduce the cost basis.

- Risk: Stock price surges after selling a covered call.

- Mitigation Strategy: Set your strike price at a level where, if the stock price does surge and your shares are called away, you still make a satisfactory profit.

- Risk: Lack of capital when the sold put is exercised.

- Mitigation Strategy: Always ensure you have enough cash on hand to buy the stock at the strike price if the put is exercised (hence, “cash-secured”).

- Risk: Market volatility causing substantial swings in stock price.

- Mitigation Strategy: Regularly monitor the market and your positions. If volatility increases, consider closing your position or rolling your options to mitigate potential losses.

- Risk: Stocks with low options liquidity could limit the execution of the Wheel strategy.

- Mitigation Strategy: Focus on stocks with high options trading activity. This will allow for smoother execution of the Wheel strategy, providing more opportunities for selling options and potentially leading to better fills.

Unlocking Greater Profitability with Option Samurai

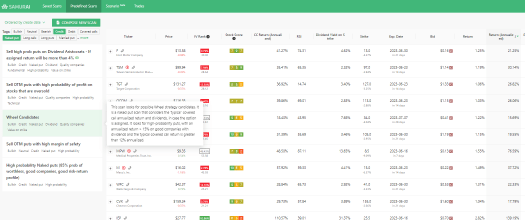

Navigating the Wheel strategy requires detailed analysis and precise selection. Option Samurai excels in this regard, scanning the full market, conserving time, and setting the stage for sustained profitability.

Option Samurai offers a unique suite of advantages in executing the Wheel strategy:

1. Wide Market Coverage

Option Samurai ensures wide market coverage by scanning the entirety of the market. This comprehensive approach ensures access to the most promising trades, mitigating risks such as biases and herd mentality.

2. Efficiency Boosting Tools

Option Samurai is designed for optimal efficiency. It features tools aimed at improving your workflow, including:

- Saved Scans: Option Samurai allows you to save selected scans for easy and swift future access, streamlining your trading process.

- Watchlist: Enhance efficiency by creating a custom list of stocks. Update this list to automatically refresh all related scans, keeping tabs on all potential trades.

- Alerts: Stay informed without constant screen time. Option Samurai’s alert system diligently monitors your scans, notifying you via email when new trades emerge.

3. Consistent and Systematic Approach

Samurai prioritizes a systematic approach, fostering replicable processes that enhance long-term trading success. By following a consistent methodology, you can improve the predictability of your trading outcomes.

4. Customized Features for Ease of Use

Option Samurai provides a range of filters and features to implement your strategy with simplicity and effectiveness. These unique tools are designed with traders in mind, making the process of buying and selling options hassle-free.

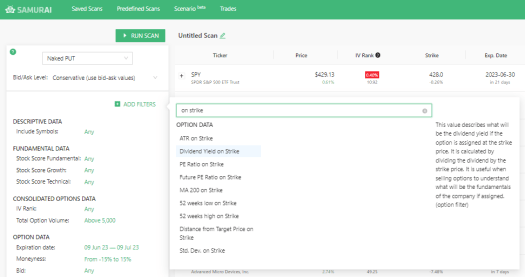

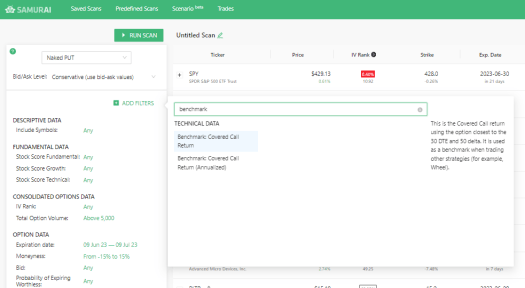

When you scan for trades right for Wheel Strategy, Option Samurai offers targeted filters, including:

-

- Measuring Liquidity. It identifies options based on liquidity parameters, like total options volume > 5000.

- Profitable Stock Identification. Utilizes PE/FPE ratios, EPS, Growth rates, and more to find potentially profitable investment opportunities.

- Determining Dividend-Yielding Stocks. Streamlines the task of identifying stocks offering dividend yields above 2%

- Return Assurance. All options trades carry risk. You want to be sure you are compensated for taking this risk. You can use filters to find the options return quickly. We suggest starting with more than 15%.

- Value on Strike. Get to see what the ratios and values of the stock will be at that strike price. Gain visibility into future ratios, such as dividend yield or profitability on that strike, so you can manage your positions. Read more here.

- Future Ratio Analysis. Options Samurai also provides insights on key metrics from analysts to help you see the market expectation for the future: Such as analyst target price, future growth rate, and more.

- Covered Call Return Estimation. You can see the average covered call return for the stock, even before selling the put option. This helps you find prospective trades better.

As a convenient starting point, Option Samurai offers a pre-defined scan specifically designed for implementing the Wheel Strategy. Pictured below is “The Wheel Candidates” scan, showcasing options based on the discussed parameters and designed to help you get started. Explore this scan directly via this link to commence your efficient and profitable trading journey.

With this tool at your disposal, initiating the Wheel Strategy has never been simpler. Embrace the synergy of the Wheel Strategy and Option Samurai to elevate your trading performance today. Up next, we’ll explore key tips, tricks, and tactics that will expedite your implementation of the Wheel Strategy, paving the way for profits.

Navigating the Wheel Strategy: Five Essential Tips

Navigating the Wheel Strategy’s intricacies can be made simpler with a few expert tips. By focusing on these key areas, you can maximize your profits and minimize risk while applying this strategy.

- Pick Mildly Bullish Stocks. Consider larger companies that show consistent, albeit slower, growth. Their size and stability often make them ideal candidates for this strategy.

- Select Dividend-Paying Stocks. Dual income streams can be achieved when you choose stocks that also pay dividends. It’s an additional benefit on top of the premium you collect from selling options.

- Focus on Profitable Stocks. Choose stocks from companies that consistently report profits. These often have a better chance of maintaining their value or appreciating, thus reducing potential losses.

- Be Aggressive with Puts more than with calls. Put options are often more expensive. Being aggressive in selling them can result in higher premiums. Take advantage of this by aiming for those with a significant time value, which boosts your potential income.

- Choose Call Options Above Your Cost Basis. If possible, sell call options with strike prices above your cost basis. This allows you to profit from both the premium and the potential capital gain if your shares get called away.

Trading with the Wheel: A Samurai’s Journey

Embrace financial prosperity with the Wheel Strategy, a powerful method for steady income and prudent risk management. Leverage Option Samurai to implement this strategy more effectively, with its comprehensive tools and user-friendly platform designed for optimized trading. Discover the difference yourself — sign up for a free trial today.

Further Resources:

- Option Samurai: Visit Option Samurai to sign up for a free trial and experience the robust platform firsthand.

- Wheel Strategy: Access our predefined Wheel strategy (account required) to gain insights into our methodical approach.

- Value on Strike: For an in-depth understanding of “Value on Strike,” read our comprehensive guide here.

Go to Option Samurai and try this now.

YES —-There is a third option – to roll the put option for additional credit, but this depends on the market conditions and is outside the scope of this article. If there are requests for that, we will write some tips for that.

Thanks! I’ve added it to our requests and we will add it in the future

[…] journal, traders can quickly and risk-free learn new strategies, like the Iron Condor or the Wheel, by documenting and evaluating their paper trades, thus simulating realistic market conditions […]

This article points out the dividend income for CCs, but neglects to point out that for a CSP most brokers pay interest on the cash reserve, which these days can be a nice boost to the income from this step in the wheel.

Yes. You are right. I’m with Interactive Broker. They give 4.83% annualized if the amount is above 10,000$.

It’s a nice addition.