A few weeks ago I wrote about the actions the Fed is taking in order to stimulate the economy. If we look at the results, those actions seem to have paid off greatly. This week I wish to talk about the actions the Fed takes on the international level and kind of creating a guarantee on the Dollar as a global currency (this makes it more valuable than other currencies – including crypto ones – that don’t provide these guarantees).

The US Dollar is enjoying a unique status as a global reserve currency. Some estimate that as much as 50% of the worldwide import is done in USD, even if neither party is American. Furthermore, 40% of the global-non-US debt is in USD. This brings unique benefits to America: companies can operate with less financial expenses, tourists can always exchange currency in their destination, etc. However, the most important part is: The US can print a $100 bill for cents. A foreign government will need to provide services worth $100 to acquire this bill. This means that the US can simply ‘print more’ USD whenever it needs. This gives the US ‘Exorbitant Privilege’ in the global economy (book here).

But the USD was not always the global reserve, the GBP fell from grace after world wars and so did other currencies before it. To keep that from happening – the Fed is taking action to alleviate the global USD shortage and make sure the USD can be used as a global reserve without a hitch (even during a pandemic).

In this article, I’m going to describe some of the programs the FED has initiated OUTSIDE of the US borders to provide USD liquidity to foreign governments.

US Dollars SWAPs

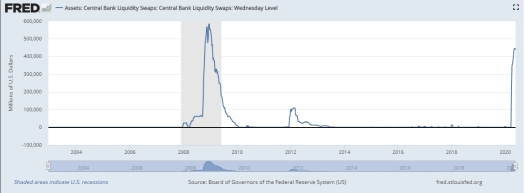

This program started in 2008. It allows 14 global central banks to take a loan in USD from the FED and use their LOCAL currency as collateral. Since the foreign bank can just print its local money, it will always have a way to pay back the loan, but it also explains why this program is limited to 14 countries. This chart describes the increase in liquidity swaps (above $450B at time of writing this):

https://fred.stlouisfed.org/series/SWPT#

Global Repo

A repo trade is a short term financial trade where one party loans the money, and the other provides bonds as collateral. In this program: global central banks can bring US government bonds as collateral to the Fed and receive USD cash. While this program can seem weird, allow me to explain:

Most countries hold USD as part of their FX reserve. However, they don’t keep US cash, but usually government bonds. In this time of uncertainty, they needed the money fast, so they sold the bonds. Over $150B of bonds were sold in one month. This selling pressure lowers the price of the bond, raises the interest rate, and works against what the Fed is trying to do. This is why the Fed allows the banks to take loans and not sell the bonds. The Fed actually becomes a bank for the world central banks.

In recent years we hear a lot of talks about ending the status of the USD as a global reserve currency. Whether it will be the Euro, Yuan, or Bitcoin – there are many contenders. However, these actions by the Fed prove that there is no REAL competition to replace the USD. So even if countries are willing, there is no real option. At a time of crisis, where financial markets can fail because of pressure (negative oil, for example) – the Fed showed the world that the USD has a ‘responsible adult’ someone that will make sure there is no shortage and you can ‘count on it.’

I think that this action by the Fed is impressive, and it would be interesting to continue and follow how the story will unfold going forward. While this analysis has no direct effect on trading, I think it is important to know.

We have recently launched some new features, so feel free to go to the platform, and take us for a free trial: