June is upon us, and we are so happy to announce the new features we just deployed! We are working hard to continue and develop new features for you, and we plan to add even more features in the coming weeks. Stay tuned and continue to provide us with excellent ideas!

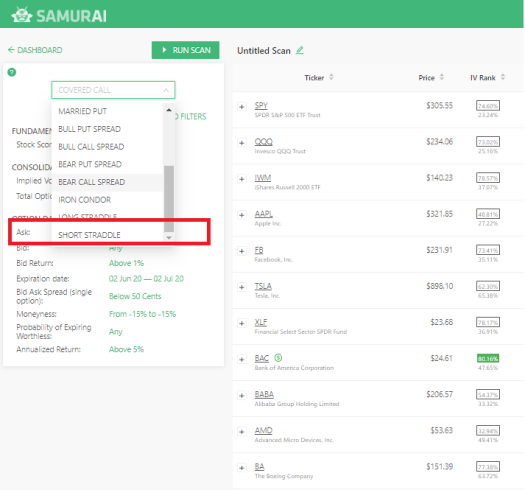

Short straddle

We have added a new options strategy – Short straddle. This strategy is best when you want to profit from a decrease in implied volatility and believe the asset will not move much. It’s built by selling put and call options on the same strike. We consider it a more advanced strategy, best combined with other strategies as a hedge (or a stock hedge).

Vega data point and improvement of other greeks

‘The Greeks’ are the measures that help us understand how the option strategy will profit or lose if one of the inputs will change. Vega, the new addition, is a measure of how the strategy will change by a change of 1% in implied volatility. We also improved the delta and theta calculation to correspond with the strategy. You can now look for an iron condor with 0 deltas (delta natural) or a positive one if you predict a bullish drift, for example.

Beta

Beta is a measure of a stock volatility compared with the overall market. We’ve added this data point for all stocks, and you can use it, for example, to find trades on highly volatile stocks or stocks that are negatively correlated with the market.

Stock data point:

We’ve also added three more data points for all the stocks:

Price to Sales (P/S) – This is a measure of the revenues of the company compared with the market capitalization of the company. You can use this to value a company that doesn’t have profits yet.

Quick Ratio – This is a measure of the company’s liquidity. A higher value is better, and it can help understand if a company can pay off its debt in the coming year. We will mainly use it in difficult times where it is not clear that a company can restructure debt).

Return year to date – This is a technical measure that will effortlessly highlight the market winners and losers and will allow you to open trades on them quickly.

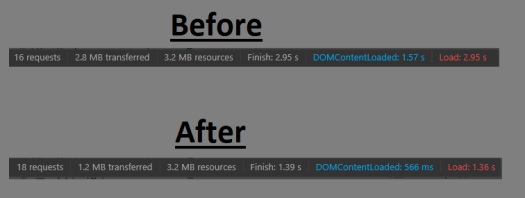

Faster site

We continued to improve our servers and infrastructure, and we deployed our platform to a CDN that will allow for distributed and local servers to deliver data to our users. The site should work faster for everyone, but the further you are from the east coast, the more improvement you’d see.

Bug fixes

Crushed some more bugs. Those bugs don’t stand a chance! 🙂

As always – feel free to contact us with any request or idea.