As part of this FAQ post we are going to expand on the different option scanners available on option samurai. You can read more about adding a new scanner on a post with that name.

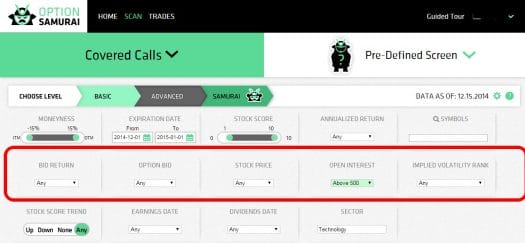

First thing we see is the options level:

We can see that we can change the level from Basic to Advanced or Samurai. The higher the level the more scanner we have. In the Advanced level all the scanners are drop down menu and in the Samurai level all the scanners open field.

The Option Scanners:

Moneyness is measuring how far the strike from the last price.

Expiration date – limiting the expiration date of the options

Stock score – limiting the stocks scanned by our proprietary scoring system.

Annualized return – search by minimum annualized return. This is a standardization of the bid return to annual figures to allow for easy comparison of options with different time frames.

Symbols – limiting the scan to specific symbols (separate by commas). You can copy-paste from excel and add as many symbols you like

Bid return – Scan by minimal desired return for the trade based on bid price.

Option Bid – Scan by option bid price.

Why bid price?

We use the bid price for selling options and the ask price for buying options in order to provide realistic expectation when scanning. You should be able to improve your price when trading, but for scanning it is important not to waste time on trades that are hard to execute.

Stock price– Scan by stock’s Last price.

Open interest – Scan by minimal open interests on the option contract. You can read more about open interest here

Implied Volatility Rank – Scan by Implied volatility rank. Implied Vol Rank is a unique algorithm that rank the stock’s IV over the last 200 trading days. Value of 90 means the current IV is higher than 90% of the IV over the last 200 days. read more about Implied volatility here.

Stock Score Trend – We are not only scoring stocks, but we are also looking at the trend over the last week. If the stock score has risen the last week the trend will be up (green arrow). Trend down (red arrow) means that the stock score has fallen in the past week.

Earning date – Scan for trades that do don’t have earning dates before expiration.

Dividends – scan for trades with dividend ex-date before after expiration. This helps generate edge when trading stocks that distribute dividends.

Sector – Find trades in specific sectors.

For debit strategies we’ve added appropriate screeners.

Break Even – Break even is the point where the option position will be 0 at expiration. Beyond that point the position will be profitable.

Max Loss $ – Limit the trades to a fixed $ amount of loss. You won’t be able to loose more than that amount.

Max Loss % – You can limit the loss of a trade compared % of the original stock position.

We’ve added unique screeners that allow traders to compare volatility to other variables and thus get better results.

ATR VS BE – Compare the ATR (stock volatility) to the break even point of the position.

ATR VS Strike – Compare the ATR (stock volatility) to the strike to ensure the strike is far enough for the trade.

ATR $% – Allows to filter the results according to stock volatlity. In $ amount or in percentage.

Read more about ATR here and see the edge here.

Bid Ask Scanner:

The bid ask scanner is only part of intraday scanners and it measures the liquidity of the options by looking at the spread between bid and ask. This can also give you a good idea of the slippage you will have when trading the position:

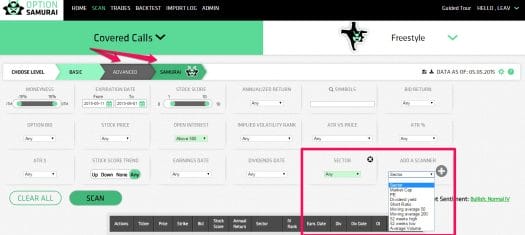

Addable scanners:

Add a scanner allows you to scan according to stock criteria:

- Sector – limit results to trades from a specific sector.

- Market cap

- PE

- Forward PE – What will be the PE ratio with the current price and the average of the analysts estimates for EPS

- Dividend yield

- Short ratio

- Moving average 50200 – The percentage between current stock price and the 50200 days moving average. This can be used for trend – Bullish when above and Bearish when below.

- 52w High Low

- Average Volume (over the last month)

- EPS growth 5 years – The analysts’ estimates of the future growth of the Earning Per Share of the company.

- Insiders transactions – Are the insiders buying or selling the company.

- Short Ratio – The amount or shares short divided by the average volume. For example: a short ratio of 10 is considered high and it means that it will take 10 days to cover all shares that are short with the company average daily volume.

- Performance month/quarter/6 months/year – The company performance over the last time period

The probability scanner filter trades according to the probability of the option to be in the money at the expiration. We use the Delta to get an approximation of the probability. read more here: http://blog.optionsamurai.com/new-feature-probabilitydelta-scanner/

Read more:

-

- Read a comprehensive guide on Option Samurai

trying to understand prbability of worthless percentage

Hey Charles, We have information about it in our help center: https://samurai.froged.help/docs > Filters & Data. Also – check the Expected value article in the Unique features sections.