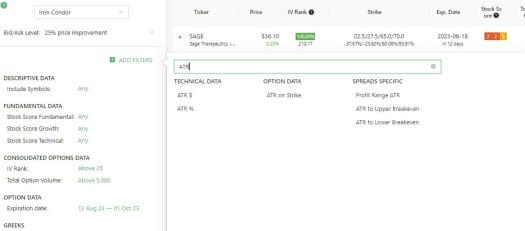

We are very happy to announce that we have added an ATR scanner (Average True Range) to the app. Our Options scanner seamlessly integrates with our present scanners and allows you to scan past stock volatility, among other options characteristics.

The ATR scanner allows to scan by $ movement, % movement, and compare the ATR to price or breakeven point for advanced scanning.

For example, You can scan for stocks that the breakeven point is 3 times smaller than the ATR. This means it is very likely that a random stock move will lead to profit. The Comparison of ATR to the breakeven point allows you to see trades where the breakeven point is 1% from the current price (If ATR is 3%) or trades where the breakeven point is 0.33% (if ATR is 1%). The comparison of ATR to a variable is superior to the comparison to a static number and allows you to find better trades.

We also added pre-defined screens based on ATR criteria to help you find trades fast, or help you start customizing the scan to fit your own needs. When comparing ATR in debit strategies (like buying put or calls), we look for ATR vs. BE point – where we want the lowest value possible. In income strategies (such as selling naked put), we look for ATR vs. Strike and want the largest value (furthest) that still gives a satisfactory yield.

You can read the ATR filters by pressing the ‘add filter’ and searching for ATR. Some of the Filters available:

- ATR in $ basis

- ATR in % basis

- ATR on Strike (distance in ATR units)

- Profit range ATR (the profit range in ATR units)

- ATR to Upper/Lower Breakeven.

Read our complete guide on how to trade options with the ATR indicator: ATR Option Trading Strategies: Ultimate Guide for Trading Options with ATR

This article was originally written in Feb 2016 and has been updated since.