On the doorstep of the Q4, U.S. stocks continue to trade at elevated levels. October is generally remembered as a volatile month, but over the last 20-years the S&P 500 index has returned 1.9% on average moving higher 65% of the time. Despite verbal barbs between President Trump and Kim Jong-un, stock prices have climb, and volatility has tumbled. In fact, the VIX volatility index is printing below 10, and is trading near the 2017 lows. While stocks climb the wall of worry, using a covered call to add to your returns and protect again an adverse move is a prudent strategy.

Covered Call

A covered call trading strategy, is one where you use the sale of a call, to enhance the returns that you can receive from owning a stock. When you sell a call, you receive a premium, but are obligated to sell that stock at the strike price. When you sell a covered call, you already own the stock, which is delivered to the call buyer if the price exceeds the strike price of the call option on the expiration date.

When you are searching for a covered call, you can analyze it in 2-different ways. You can look for a stock that you are interest in purchasing and then see if the value of the calls options is attractive, or you can scan for a covered call using option trading software like Option Samurai. Either way, you still need to analyze both the option information as well as the chart technicals to determine if the trade is attractive.

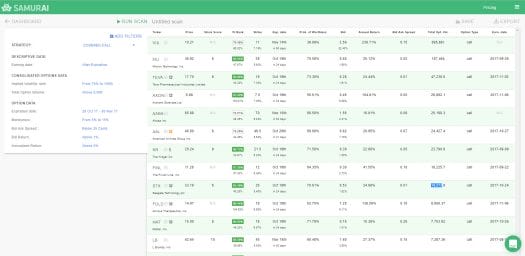

Running an Option Samurai Scan

There are several criteria that are key to finding a robust covered call. One of the first, is determining if you want to term of the option to extend through an earnings date. There are pros and cons of having each, but you are subject to a lot more actual volatility after and earnings date, and although you get some downside protection from a call option sale, it the protection is not significant. If you do extend the option through the earnings date, the implied volatility is likely to be higher. After an earnings release, volatility can remain high, so checking the volatility ranking and having it over 75% is prudent. You want to make sure the option is liquid so look for volume of more than 5,000. An option expiration of 3-weeks or more should give you sufficient premium. Additionally, you want to make sure the bid offer spread is reasonable, and the return is at least 1%, that annualizes above 5%.

Micron’s share price is breaking out, and very robust volume which is important when a stock price breaks out, following the better than expected financial results released by the company on 9/26/17. Micron reported Q4 revenue of $6.14 billion, a solid 91% improvement over the Q4. Micron reported earnings of $2.02 a share, compared to estimate of EPS of $1.84 on revenue of $5.96 billion.

Here you could consider a covered call sale that would include:

- Micron (MU) October 19, 2017 $39 Call at $0.60.

- You participate in the upside until $39, and receive a premium of $0.60.

- Your downside breakeven is $0.60 below your stock entry price

- You max gain is $39 – entry price + $0.60

- Total return above $39 with an entry price of $36.92 (close on September 27, 2016) is $2.68 / $36.92 = 7.3%.

Alternative, you could also go to your dashboard and look for alternative covered call scans, using this scan as a guide.

Sign up for a free trial now to start finding profitable trades today.