As you might know by now – we are traders ourselves, and we built SamurAI as we felt the tools out there are not satisfying for our needs. We use our scanner daily and share some of the actual trades we make with our subscribers. All trades we share are found with the scanner. Follow us on Stocktwits or join the newsletter to be kept in the loop.

We keep a public trade log where everyone has access and can see the trades we preformed, and more important – their outcome.

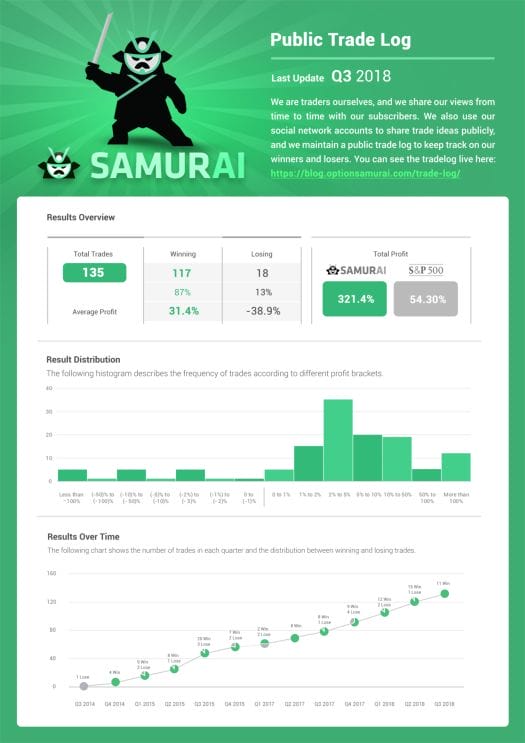

We will try and keep an updated infographic and details in this link, but if you want to see most recent results you can go to the spreadsheet and analyze the results. This is the most recent summary for the end of 2018 (Q3):

All the trades were found using our Options screener.

The interesting result is not only the high return (that beat the benchmark) but also the distribution of the results – we can see a positive skew in the P&L distribution.

Since that report we added 26 more trades:

- 1 trade closed in a loss

- 6 trades are still open

- 19 trades closed for profit

Some of our recent trades:

- Selling puts on GE mid-December. Fear levels were high, but it didn’t look like GE would go bankrupt. We got 5.3% return on risk which was 63% annualized.

- We traded UVXY 4 times (betting the fear index will not continue to climb) and won all the trades with ~50% return in ~3 days (each).

- Check the full trade log

- Follow us on Twitter and Stocktwits to see the trades

Read more:

- You can read our trade post-mortem on trades we’ve made on $BIDU, $FL and $PM

- See our previous Trade log update.

All the trades are found on our screener. Check out the scanner here to start your free trial and find more trades suited for your needs: