This article will be a short technical how-to article to help you create scans for your investing process. We use it personally to quickly access our scans in our daily routines, save time, and build our knowledge of the market behavior.

Processes and routines

Making a repeatable process is critical to generate consistent gains in the market. Having a reliable method saves time, helps us ignore the noise while always keeping our eyes on the essential aspects of trading. As the market change, it is also easier to investigate the process and adjust it than fix an ad-hoc trading method.

There is much to say about workflows, routines, and processes, and we will discuss it more in future articles. In this article, we will utilize Chrome to save us time in our daily workflow.

How to build the links in Chrome

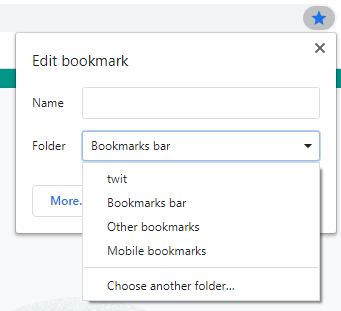

OptionSamurai’s links are bookmarkable: If you look at the address bar, you can open a scan (in this example, I’ve opened one of our predefined scans), and if you click the star (or ctrl+D), You will bookmark the page. Use a concise name to help you identify the scan later.

![]() Bookmark your scans: Open the scans you want to regularly follow in the ‘edit’ view and bookmark them (you can also ask us for help).

Bookmark your scans: Open the scans you want to regularly follow in the ‘edit’ view and bookmark them (you can also ask us for help).

Add those scans to a folder: When you click on them, you can add those scans to a folder. Then you can open all links in the folder with right-click.

Done: Now, whenever you want, you can right-click the folder and open all links at once.

* This works on all modern browsers.

What do I have on my daily list?

- Trade Log – I use Google sheet as my trade log, with a separate sheet for each strategy. While not ideal, it gets the job done.

- Favorite financial portal – I use Finviz, but you can use Yahoo! Finance, Market Watch, Bloomberg, or any other financial outlet. I usually scan the headlines to understand what people are talking about. I don’t often trade from the headlines as I’m reactive and not proactive like I’m with my scans that Samurai produces.

- Naked put scan on my universe – As part of my system, I make many small trades weekly. My favorite strategy is naked put, so I look at it daily and change the sorting and settings to know what trades are available.

- Buying calls on my universe – I have another process for debit spread, so I look at it as well.

- Oversold puts – This is the predefined scan, and I adjust it as needed. Sell OTM puts with a high probability of profit on stocks that are oversold (you need to be logged in)

- Earnings – I have a scan that shows me the earnings in the coming week for my universe. (Will create a tutorial on how to build it)

- Naked puts on Dividend Aristocrats: Dividend Aristocrats are one of my favorite universes. The regular dividend makes their movement more predictable, in my opinion, so I follow them regularly.

- Hedge scan – Currently, I’m bullish, so all my scans are bullish as well. This scan is bearish – Buying put debit spread (bear put spread) on ETFs (SPY, QQQ, IWM) that have a profit ratio of about 1000%. I use this scan to find trades to hedge the positive delta in my portfolio when I deem fit.

- Per stock scan – This is a loose scan on one symbol that I use to analyze a stock that I hear about (from news, friends, clients, etc.) This is just a quick way to look at the entire chain and data for a stock I’m interested in.

I hope my process will give you ideas on how to improve your trading. You can and should adjust the scans to fit your strategy. We have more surprises coming in the next few months, so stay tuned 🙂 .