Just as 2019 is starting, we are happy to announce that we’ve rolled out some of the features we were testing over the last few weeks.

IPO Date filter:

We’ve added an IPO date filter that allows you to search option trades on stocks that just IPOed. Often, stocks have sharp moves after IPOs and this will allow you to find the optimal options trade on them.

To add the IPO filter: In the scan window, go to the ‘add filter’ and search for ‘IPO’ in the search window.

Analyst target price:

As continuation of the previous release, we’ve added the analysts’ target price for each stock. This will allow you to scan stocks according to the distance of current stock price from the target price. Traders can capitalize on this data in order to help them assess the potential p/l of a strategy. For example: If we see that a stock has buy rating from analysts and distance of more than 30% between current price and the target price, we can aim to buy calls in order to capitalize on that.

To add Analyst target: In the scan window, go to the ‘add filter’ and search for ‘Target’ in the search window.

Save as new

Many users asked us to create a ‘save as new’ button to allow to create and save similar scans with small changes (for example – same criteria but different watchlists).

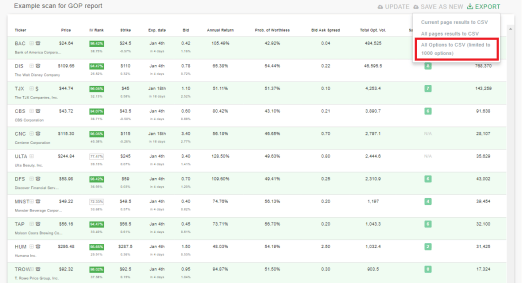

Export all options

Option Samurai automatically groups different trades of the same symbol in one row. Clicking on that row will show all potential trades on this symbol. Export all options to excel will export all trades, and not just the best trade per symbol. This will allow better excel analysis.

General improvements

We’ve added some general improvements, bug fixes and speed enhancements to the site.

As always – Feel free to contact us if you have any question or idea. We are working on more features and you can expect more improvements in the coming months, so stay tuned..