We Are very happy to announce the launch of the new version of Option Samurai. We will describe all the new features and how to use them in next posts and in our help section, but we want to describe some of the new features in this article:

Spreads Scanner:

We’ve seamlessly integrated spreads scanner. Our platform now supports:

- Bull call spread

- Bull put spread

- Bear call spread

- Bear put spread

Our new scanner filters through tens of millions of options combinations to find the best spread. We can find the best spread while taking into considerations: Probabilities, profit/loss ratio, bid-ask spread, stock technical and fundamental data, insiders transactions and more.

It is the most advance spread scanner around.

Go to Option Samurai

The best Iron Condor ever!

Iron condors are very popular among option traders as they maximize the time decay while keeping the maximum loss of the strategy fixed and known. However it is hard to find the optimal legs for this strategy. By optimal we mean the maximum profit vs risk vs probability of achieving each of them happening.

This is why most traders resort to ‘fixed’ legs such as X% from stock price or Y delta. This means these traders are leaving profits on the table!

We believe we can do better: For every Iron condor we test all possible combination that fit your criteria and find the maximum expected value. We want to optimize the risk adjusted returns while taking into account the probability of the event manifesting.

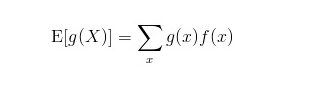

Expected value:

Expected value (EV) is a statistical measures that tries to predict the value of a variable. In our case, it is a statistical measure that tries to predict the profitability of a trade. It is simply the payout the strategy will yield in different scenarios multiplied by the probability of this scenario. In other words, the sum of:

- Probability of max profit * Max profit

- Probability of max loss * Max loss

- Probability of partial profit and partial loss * payout

There are many ways to estimate the probability of the events, we use the market prices of the stock and options to derive the probabilities, and use live data to constantly calculate and update them.

How to use expected value:

- You can use EV to estimate the profit of a trade if you’ll trade it small and often.

- You can use EV to compare different trades in the same stock

- You can use EV to compare different trades on different stocks and use this as standardization and comparison value

- The EV takes into account the profit, loss and probability and display it in one value which allows you to quickly make decisions and improve your trading.

We will add more blog posts describing how to get the most out of these features, but in the mean time -> don’t be afraid to contact us for help and questions.

Many more improvements

To keep this article manageable we haven’t described many of the other features we will be introducing such as: Straddles, better design and faster calculation, more option data, probabilities of profit, loss, upper or lower break-even and more!

Stay tuned and subscribe to our updates and Option Samurai to be in the loop of more new features.

I’ve not seen Expected Value calculations like yours before. Could you please provide a little detail on how you treat the area between the strike prices in your calculation of EV for a credit spread, for example?

Sure. See here: https://samurai.froged.help/docs/en/21678960-expected-value