Category: covered calls

A Comparison of Cash Secured Put vs Covered Call [P&L and Examples]

When looking at a company you like, there are different ways to invest in it other than simply buying shares. This article explores cash…

Building a Synthetic Covered Call Strategy – What You Need to Know

Options trading can give investors unique opportunities to manage risk and achieve growth. The synthetic covered call is a strategy that combines the benefits…

The Wheel Options Strategy: Your Comprehensive Guide to Steady Income Generation

Options traders, from beginners to seasoned veterans, seek a methodical approach that delivers consistent income while managing risk. This is where the Wheel Strategy,…

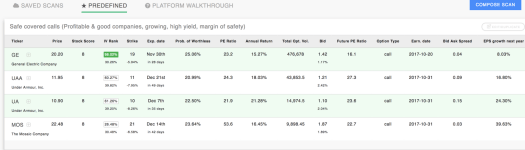

How To Choose A Covered Call Using A Predefined Scanner ($MOS Example)

In this article, we’re going to see how to choose an option for generating income. The strategy we’ll use is covered calls, which means…