Dividends and Options

| Importance: | Medium | |

| Execution: | Easy |

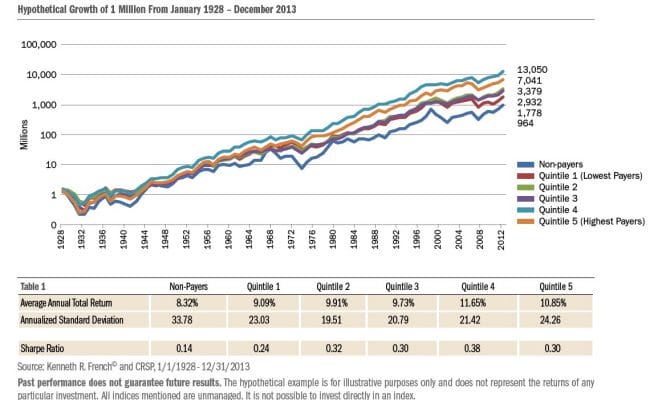

Dividend stocks often outperform the market, and stocks that distribute dividends regularly are usually considered safer. In a comprehensive study done for the years 1928-2013, we can clearly see that dividend stocks outperform the market:

(Dividends: Review of historical returns \ Heartland Funds)

The following chart is from Mebane Faber’s book “Shareholder Yield,” and it shows that dividends are responsible for the majority of the stock performance for both cheap and expensive stocks:

So, We can see that regular dividends are bullish and that they contribute the majority of the real return of stocks; there is one more mechanism to understand about options when trading options – The stock adjustment:

When stocks distribute a dividend (during the Ex-date), the price is adjusted, but the option price usually doesn’t. For example, if stock XYZ price is $100.01 and it distributes a 5$ dividend:

-

The Adjusted stock price will be $95.01.

-

This means that Call Strike 100 is suddenly out of money and

-

Put strike 100 is suddenly in the money.

If we connect these two facts, we can see that the put options’ price should rise after the Ex-date, and the call options’ price should decrease. This means we could profit from strategies like covered calls or married puts – strategies that are bullish and will profit from the expected price movement.

Tips on trading options on dividend stocks:

-

Use bullish strategies – A covered call is usually best suited for this.

-

Look for options 2 weeks to 6 weeks from expiration (usually have more premiums).

-

If you set up a new position – prefer At-The-Money options (or In-the-money)

-

Premium should be equal to the dividend since there is a high probability you’ll be assigned before the ex-date (the option buyer doesn’t want to miss the dividend). This is a good outcome since you’ll receive the premium for a shorter time frame.

-

Use OTM options if you want to hold the position for the long term and on a lower-cost basis (example).

-

Read more about The Edge in Dividends investing.

How can Samurai’s Options Scanner help you?

-

Use dividend capture screen: We developed a dividend capture screen for covered calls and married puts (buy stocks + protective puts); you can find the best trades in 1 click or edit the trades manually. Read more about How to find dividend capture opportunities.

-

Custom scan with dividend yield: You can scan all strategies (not just covered calls or married puts) and use the dividend yield scanner to filter results with a certain dividend yield:

-

Custom scan with payout ratio: You can also scan for a payout ratio in order to verify that the dividend is sustainable or reverse the scan and look for a high dividend yield with an extremely high payout ratio – hinting at the fact that the dividends might not be sustainable. You can add the payout ratio scanner similar to the dividend yield scanner above.

-

See only trades with ex-date before expiration: You can scan for trades where the Ex-date is only before the expiration, and thus make sure you gain exposure to the dividend event:

Summary and key takeaways:

-

Dividends are a bullish trigger – Research shows dividend stocks outperform the market, so we should usually look for bullish trades. We can see an out-performance of 0.77%-3.33%.

-

Option strike doesn’t re-adjust on Ex-date – We can profit from this – especially with selling calls and buying puts.

-

The easiest way to profit from dividends stocks during the dividend Ex-date would be covered calls or married puts: These are bullish strategies that will profit from the fact that the strike doesn’t adjust during the Ex-date.

-

You can use the dividend capture predefined screen to find trades quickly or use the custom scanners to find your own trades.