Implied Volatility Rank

| Importance: | High | |

| Execution: | Easy |

[2023 update]

Implied Volatility is one of the most critical concepts in trading options. It is a measure of how cheap or expensive an option is. In Option Samurai, we use the Implied Volatility percentile (we call it rank) to measure how expensive or inexpensive the IV is. For example, If a stock has an IV Rank of 95%. This means that 95% of the days had lower IV over the last year than the current one. Or, to put it simply: The current IV is high.

We have tested IV rank on indexes and significant stocks, and we can see that this calculation is mean-reverting, meaning that after a high IV Rank, we can expect a decrease in IV – and vice versa.

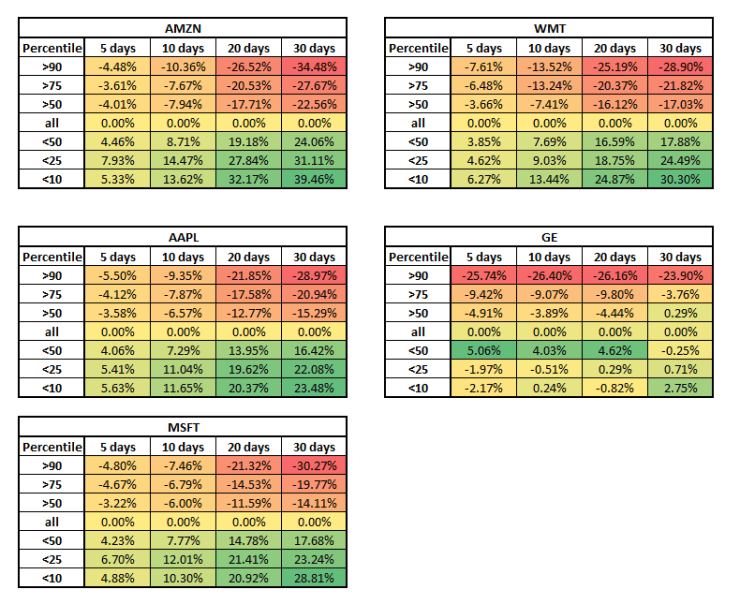

Here are the results on five highly liquid blue-chip stocks:

The tables above summarize the average future implied volatility (IV) change after different IV rank thresholds. The columns show us what was the average change after 5,10,20, and 30 trading days (corresponds to 1 week to ~45 calendar days).

For example, We can see that the IV in Amazon decreased 10.36% on average after the IV rank was above 90 percentile. Similarly, a month after it was below 10, it increased by 32.17%.

GE is a notable example of a stock that behaves a bit differently: When IV was low, we didn’t see a consistent increase in IV. This is because GE crashed during our test period from about $30 to $6 (and less), and it affected the IV. We like this example because even when the IV doesn’t behave exactly as expected, it is still reliable and doesn’t break completely.

To summarize, the IV percentile (Rank) is mean-reverting and can help us predict the future IV move. After a high IV rank, we can expect IV to decrease and vice versa.

This helps us in trading and increases our edge: when we see a high IV rank, we want to use strategies that profit from a decrease in IV, such as selling options. When we see a low IV rank – for example, 10 – we can expect a rise in Volatility and might consider buying options.

Using IV rank on Option Samurai:

Read more:

- Our updated backtest results of IV rank vs IV

- Read our part 3 in the series about trading Implied volatlity

- Read about the market sentiment edge

- Read about our implied volatility backtest