(small update: The Vix gave more than 30% and faster than we projected. If you took our idea it might be good time to take some profits off the table)

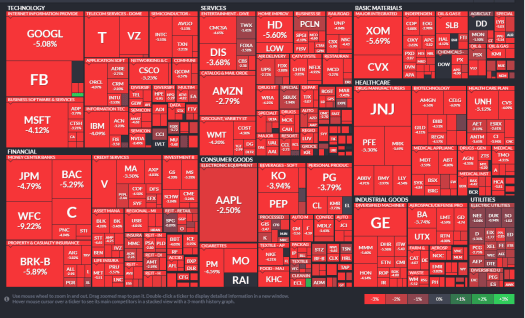

Indeed an historical event, an event that can affect the lives of many. But the Eagles win over the Patriots in Super Bowl LII is old news by now 🙂 . The media cycle has moved to the “downfall” of the stock market: the Dow Jones Industrial Average (DJIA) has suffered one of its largest loss in one day – that is in points (1,175). When looking on percentage loss, things look a bit different: the 4.6% put it somewhere in the 500th largest drop – but who will click on that?

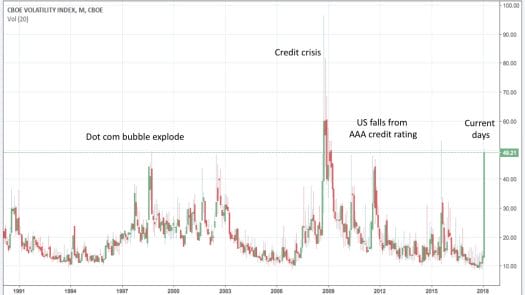

The S&P isn’t different and though there isn’t a sign for panic. But by using the VIX indicator you get a better understanding on how the market might go:

As we can see, Vix is in the 4th highest value it has ever been. What is interesting here is that the other top 3 are some of the biggest economic crisis of recent decades. Does this mean that we are heading towards a meltdown in one or more sectors? This is less likely, and this is probably the market adjusting itself due to two recent trends:

- A large amount of retail (and professional) volatility sellers

- Abnormal recent gains.

In the short term, we can expect to see an increase in the volatility, especially due to the extended period that the market didn’t have a correction. But in the medium and long term, we are seeing this as a bullish market indicator.

The change in Vix was so extreme (an increase from 10-11 to about 40 in few days) that we can expect it to over shoot and correct to more ‘normal’ volatility. This is basically how implied volatility works, with recurring ups and downs.

Based on our back-test for the last 10 years, we can expect in the next 30 days a -26.97% decrease in volatility.

Check our article about the volatility edge, the backtest we performed there and the detailed explanation about the IV Percentile to learn more. Also, our implied volatility backtest is something you should also keep in mind when trading these events.

You can trade this on the VIX future or on the ETFs, but this will effect the entire market. You can use the bull put spread scanner to find the best trades for these market conditions.