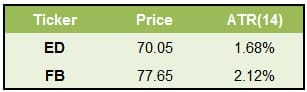

In this article, I wish to discuss the importance of volatility and implied volatility to options trading. The volatility of a stock is a measure of how “fast” it moves in each direction. If we say that a stock has high volatility – we mean it moves quickly. When looking, for example, at FB (Facebook) and ED (Consolidated Edison), we see that though both of them are stocks priced in the 70-77$ range, FB is much more volatile. This means FB moves faster than ED:

Since Option value is derived from the underlying stock and it’s volatility, options on high-volatility stocks will usually be more expensive than options on low-volatility stocks. The same concept is true for implied volatility – The future volatility as foreseen by market participants.

Usually, we would rather buy options when volatility is low (and options are cheap) and sell options when volatility is high (and options are expensive). Since we are looking at options, we usually refer to Implied volatility.

To simplify this idea, let’s look at an example:

- Stock A is priced at $100 and has high implied volatility. Let’s say that the call strike 100 costs $4.

- Stock B is also priced at $100 but has low implied volatility. Let’s say that the call strike 100 costs $1.

When comparing the two trades, we can see that the break-even point of stock A is 104$ and for stock B is 101$. This means that we have an increase of 1% to show profit in stock B, but 4% in stock A. Furthermore, if we assume a similar increase, let’s say 5% in each stock (by expiration) – we can see that we will have 1$ profit in stock A but 4$ profit in stock B. The following Table summarizes the two scenarios:

This simple example helps us understand that if the implied volatility is low, you can profit with a higher probability, and you can show a higher profit for the same move. Since options are a zero-sum game – We can say the opposite for high implied volatility – It is easier to profit when the option is expensive and IV is high. We’ve created an indicator that helps you see if IV is high or low at a glance. Check our IV percentile article here.

It’s important to note that the decision can not be made automatically without looking at the broader picture. As we discussed in the 2nd part, Trading Implied Volatility – Part 2, often – High implied volatility predicts future moves. This just means we should be more selective of the trades we take – and make sure we have a directional bias AND the option characteristics fit.

- Read the summary we wrote about IV here: Implied Volatility Rank – The most important element

- How to find high implied volatility trades: