Option Samurai

Blog

Learn. Trade. Profit.

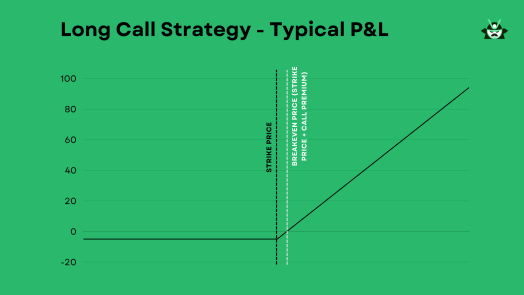

Gaining a Better Understanding of the Long Call Options Strategy

When you first approach option trading, a long call strategy may seem like the most intuitive choice. And for good reason – it’s a…

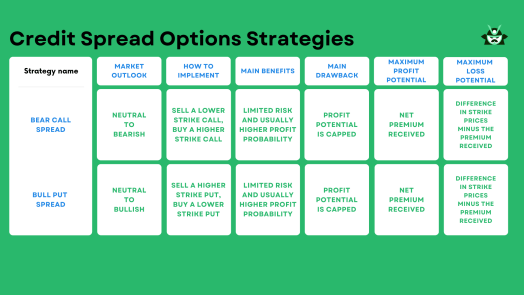

Profit and Protection: A Trader’s Guide to the Credit Spread Option Strategy

If you’re looking for a way to profit in both neutral and directional markets, credit spread strategies might be exactly what you need. These…