Option Samurai

Blog

Learn. Trade. Profit.

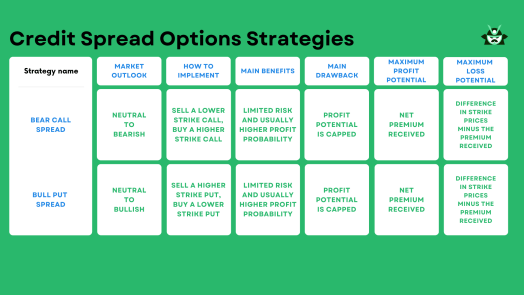

Profit and Protection: A Trader’s Guide to the Credit Spread Option Strategy

If you’re looking for a way to profit in both neutral and directional markets, credit spread strategies might be exactly what you need. These…

Managing Naked Call Options: Risks and Strategies of This Option Strategy

Selling a call is a common strategy in options trading, and there are many ways to do it. Naked call options involve selling the…