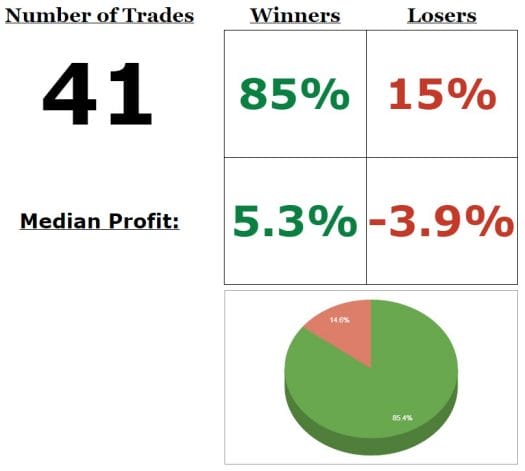

It’s been a while since I’ve done a trade post-mortem. Since we have a public trade log, you can still follow on the different trades we give. Here is a current snapshot of our current trade log:

In this post, I wish to give a little more color into why we went into those trades (at least more than 140 characters 🙂 ).

All those trades were found on our options screener. You can check it out for free.

Philip Morris $PM

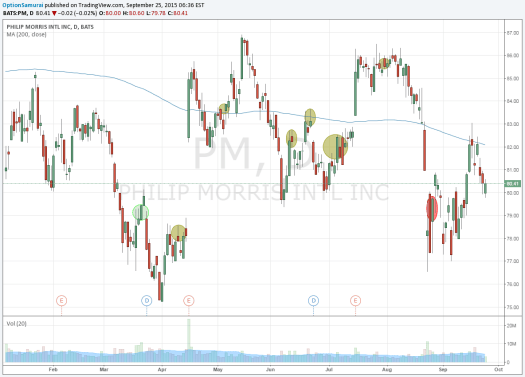

I started the trade on $PM with selling puts Out of The Money (OTM). I thought that it was a quality company with stable dividends. My plan was to buy $PM if it will breach the puts, or earn the premium if it doesn’t. I ended up being assigned the stocks, and I started to sell calls and earn dividends. Here is a chart of $PM during that period:

- The green circle in March is where I was assigned the stock.

- The yellow circles are where I sold calls.

- The red circle at the end of August is where I sold the position, to create more buying power for other positions.

Overall, While I managed to find relatively good opportunities to sell calls, the violent moves and gaps offset some of the profit. I ended up closing the trade earlier than I wanted since I needed the buying power for other trades I found after the market crash. Though ended up with a little profit. The profit was not as high as I had hoped, and frankly, not sure that was worth the risk…

Walt Disney $DIS

I love tracking mega caps companies and waiting for opportunities to enter a position. Mega-cap companies are usually leaders in their field, but are highly visible so good trade opportunities don’t come often. Usually, the market prices them fairly. So, although the risk associated with them is lower, there aren’t many trade opportunities in them. However, there are times where you can find an opportunity to make a profit on them, and when you combine it with options (leverage, higher probability of success or limited loss potential), you can increase your profitability without risking too much.

During the market crash at the end of August, Disney fell, and since I was following it, I had a chance to enter a low-risk-high-reward trade. I elaborated on the reasons to buy the company here. The trade ended up yielding almost 200% annualized.

Mondelez International $MDLZ

Again, I saw a good opportunity in this Oreo manufacturer. I used the fact that the IV were very high to sell OTM puts, and earn high yield while still maintaining margin of safety.

$MDLZ Sold Put on strike 40. http://stks.co/j35Bv – high return, 34.7% annual return.

— OptionSamurai (@OptionSamurai) Sep. 4 at 10:20 PM

Wal-Mart $WMT

Wal-Mart dropped after releasing weak earning results. This was amplified by the market panic. Since $WMT is in a different category than all other discount retailers, it looked like a good opportunity. I entered several trades – some were profitable, others losing. Overall I think the risk is manageable since if I get assigned, I’ll switch to covered calls.

Sold put on $WMT – http://stks.co/b2Sqs – 20% annualized return. Strike is at the prices of 2012. recession proof.

— OptionSamurai (@OptionSamurai) Aug. 27 at 10:00 PM

Read more:

- Check our trade log update for 100 trades.

- Check our previous Trade post mortem we did on $KO, $GIS, $MSFT and more