Covered call is one of the most popular options strategies. Last week we mentioned that option-sellers have an edge when trading, and we talked a little bit about the edges in covered calls – They out perform the market and with lower volatility (read here). In this post we will dive a bit more into covered calls and understand the different considerations when choosing the optimal strike.

The edge of covered calls

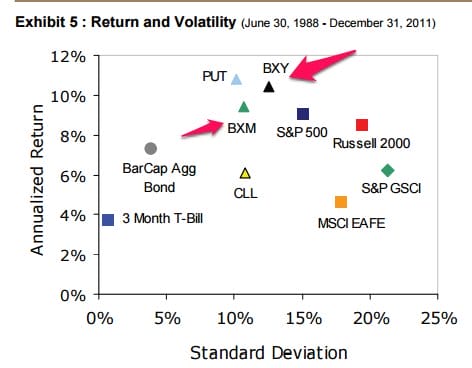

Many articles tried to analyse in a quantitative way the benefits of covered calls. The most comprehensive studies were done on the CBOE covered calls indexes – $BXM and $BXY. In the previous post we mentioned the research done by Asset Consulting Group. The research compared several options strategies and we will focus on covered calls for now:

$BXM is the CBOE index for At-The-Money covered calls. $BXY is the CBOE index for 2%- Out-of-The-Money covered calls (both on the S&P500 index). Some conclusions from the research:

- We can see that both covered calls strategies had higher return and lower volatility than other indexes.

- Selling OTM covered calls will lead to higher returns due to price appreciation, but more volatility.

- While selling ATM covered calls limits the upside gain, we can see that over the long-term the options are priced fairly and provide similar return to the benchmark. Because we receive the premium in the beginning – the volatility is lower since it serves as ‘cushion’ if the market drops.

- Average monthly premium collected with ATM options is 1.8% (almost 22% yearly).

Winning by losing less

The main edge of covered calls is derived from the fact that the premiums are sold in advance and protect the trader if the market falls. So when looking for the perfect covered call strike it is important to remember the protection we gain if the trade goes against us.

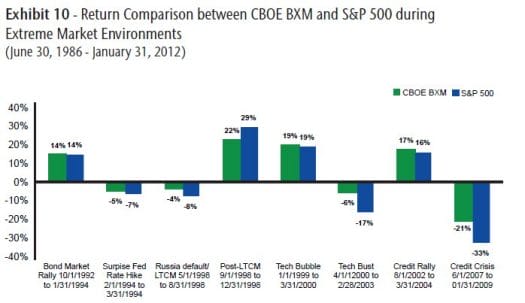

In an article by Hewitt Ennisknupp that checked the $BXM index the authors found that the source of out performance is mainly during the market bear phases:

We can see that covered calls ‘bell curve’ is much narrower than the index. The strategy protected the trader during the bear phases, and we can see that it performed well also during monumental events:

From this research we can learn that:

- Covered calls protects the trader and increases the chances of showing profit (though limiting that profit)

- Covered calls strategy performs well, even in extreme market conditions: even if market is very bullish the higher premiums usually provide high yield, even if it is a bit lower than the price change.

Options are usually priced correctly

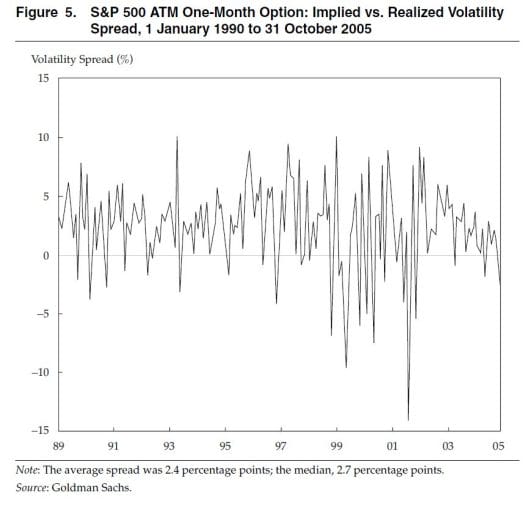

The options market is usually priced correctly, where a rise in IV usually precedes a rise in real volatility (we covered it here). This is especially true in indexes that are heavily traded and analysed. However, there are moments when the markets are not priced correctly. In an article by Goldman Sachs we can see that the IV is usually a bit higher than the realized volatility. The average was 2.4% and median – 2.7%

Some key takeaways here:

- Though IV is usually priced correctly, it is usually a bit higher than the real volatility. We can explain this by the ‘insurance’ and leverage effect that options have

- We can see that the market often overshoots: after a high spike in IV-RV spread we can see that the RV becomes higher than the IV, and then back to normal. Use the IV Rank!

- It is important to remember that in covered call there are down months where the covered calls protect us regardless of the IV.

The perfect covered call strike:

As shown above and in previous article – Covered calls have an edge. But how can we increase it?

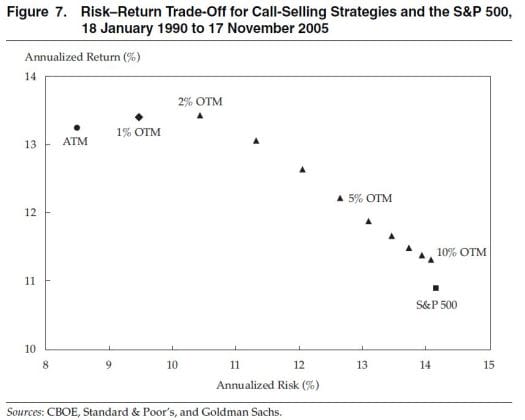

We can see that there is a trade-off between protection (selling ITM) and return (selling OTM). Usually ATM provide a good mix, but during bull trend we will be better off a little OTM and during bear trends better ITM. Here is an analysis of the trade-off on the SPY :

From GS analysis we can see that moving 1-2% OTM increased the return, but going further OTM was less efficient.

In order to find the perfect covered call strike we need perfect hindsight. However this analysis helps us understand that the ‘perfect strike’ will be the strike where the underlying will be ATM during expiration (and thus having zero value this expiration, and the maximum premium for the roll).

Tips for trading covered calls:

We saw that covered calls have edge and can improve your return and limit your risks. Here are some practical tips to make you even a better trader:

- Prefer to initiate and roll the positions when IV rank is high. we saw that market tends to overshoot its predictions.

- Try to avoid holding a position during earnings – we covered it here.

- Sell meaningful premiums – very cheap options (10-20 cents and lower) don’t really provide protection and only limit your potential. Further more if you want to roll the position you will give up substantial chunk of your profit to buy it back.

- Roll or close trade early – If you achieved 80% of potential profit or if the option is worth 5-10 cents – you can roll or close the trade.

- Limit risk – If you started a short-term position – choose In The Money options or At The Money options to provide you with more protection. If the position is for long-term – prefer Out of The Money options that might not provide as much protection but will provide some protection while not hurting the upside protection as much.

Put it into action with Option Samurai

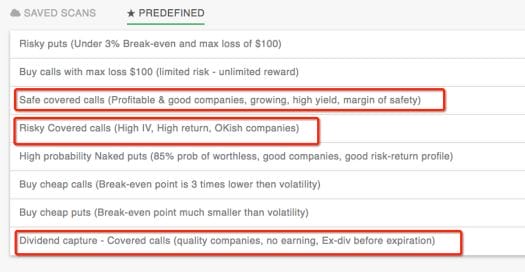

You can use Option Samurai’s predefined scans to find the best covered calls:

Or create your own covered call:

- Signup for free (no credit card needed)