After months of planning, designing, working, and testing it internally, we are happy to announce that the new version of April 2021 includes a whole new module: The Trade log. Technically, this feature allows you to add trades from our scanner and track them over time. But more importantly, it will enable you to learn and test new strategies, improve and easily track current open trades and, with coming improvement, will allow you to adjust trades, backtest, and more.

We are excited about this version. Here are the improvements included:

- A public beta of the Trade log feature

- Added new universes for ETFs constitutes

- Added new data points for the scenario engine

- Added options expiration cycle filter

- Server improvements, Bug fixes, and UI improvements

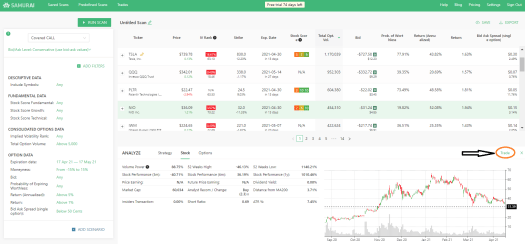

Public beta of the Trade log feature

This is a significant addition to this version. The trade log is a whole new module accessible from the top menu bar. It has two main sections:

- Open trade – This allows you to track your open trades and see the current stats (IV, Greeks, Profit/loss, etc.)

- Closed trades – Allows you to learn and analyze past trades.

You can add trades from the analysis tab in the scanner:

You can access the help center article for more information: Trade log help article

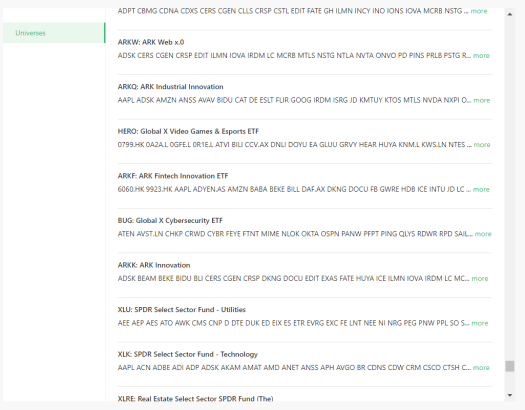

New universes

Universes are our watchlists that allow you to filter the market and find trades only on stocks that interest you. In this version, we’ve added automatic universes that are updated weekly with the constitutes of popular ETFs. This helps you create automatic scans according to themes. We’ve added about 18 ETFs: ARK investments ETFs, S&P500 Sectors, and gaming and cybersecurity ETFs among them.

Checkout the Universes here: Automatic universes

And help article about them: Universes help article

New data points for scenario engine

The scenario engine is one of our most advanced features. It allows you to set a scenario, a ‘what-if,’ for the entire market and find the strategies that will profit the most from that event. For example, if you are bullish, you can set a scenario that the market will increase 10% (or one standard deviation, or 3 ATRs) and find the most profitable strategies.

In this version, we have added the ability to set 52-weeks high and low as scenarios. These are useful in a retracement or ‘Buy the dip’ situation. For example, you can look for call spreads with the highest return if stocks you are bullish on will return to 52 weeks high (or rise above it).

Read more about the scenario engine

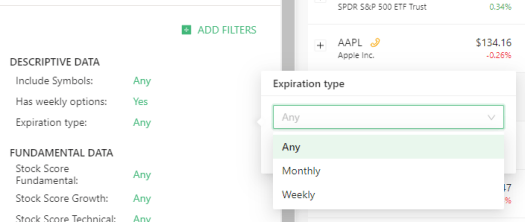

Added options expiration cycle filter

We’ve added a filter to control the expiration cycle of the options. You can filter for only monthly options, only weekly options, and you can also look for monthly options, but only for stocks that have weekly options.

This filter gives you more control over the results you will get.

Server improvements, Bug fixes, and UI improvements

We are continuing to improve our product and the features we’ve already deployed. We increased our servers’ power, improved on the UI, and fixed bugs.

The version is live now. Log in and try it now.