We are so happy to announce we just deployed a new version! The latest version includes new features, a whole new engine that will allow for unique usage, bug fixes, and general improvements.

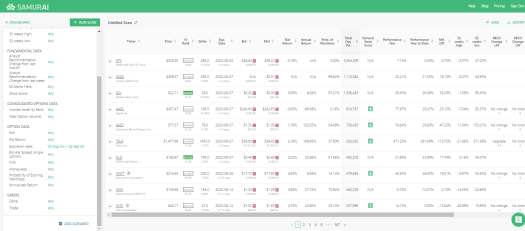

The Scenario engine

The scenario engine allows you to scan the whole market and find the best trades that fit your outlook. You can describe this outlook in percentage, standard deviations, or values such as moving average, analyst’s target price, and more. This is very useful as you can find trades across the market and utilize the intraday prices to find the best options for you.

Some use-cases can be:

- Find weekly options that will multiply in value if the stock moves 1 Average True Range (so even ‘regular’ move can result in more than 100% profit). We have two predefined scans for these scenarios.

- Find call options/ call spreads that will give 1000% profit if stock arrives at analysts’ target price.

- Find Iron condors that will still be profitable with a standard deviation more in each direction.

- If you think Sliver (SLV) will increase by the end of the year, what are the best options to buy.

- And more.

You can read more about it in the announcement or our knowledge base.

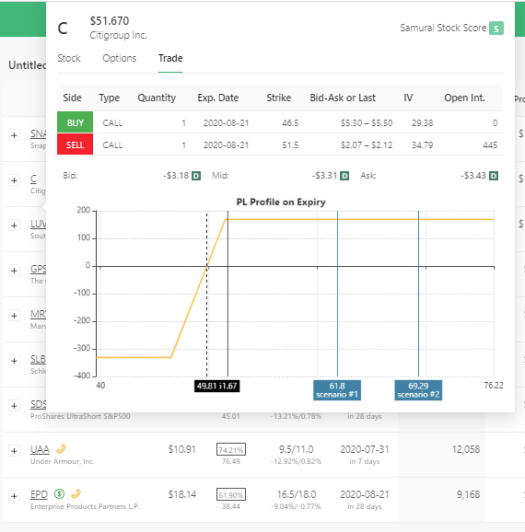

Trade tab

We improved the details tab, so now you can see the profit and loss of the strategy and the prices of each leg you want to execute (It also works really well with our scenario engine).

Read more in our knowledge base or blog announcement.

Horizontal scroll bar

We added a scroll bar so you can more easily analyze trades if you have a table with a large number of columns.

Social signup

We added the ability to signup and sign-in with Google, Facebook, and Twitter for easier access. If other social networks are helpful – let us know.

Bug fixes and improvements

We continued to make small improvements to the app and data and fixed some bugs.

We continue to work to deliver new features. We are working on Technical analysis indicators, an improved stock score, and more. Let us know what you think and if you have suggestions for other features.

The new version is available – click the button and go to Samurai for 14 days free trial.

HI – I just discovered your platform and already love it. It is saving me a lot of time scanning for trades. I am still learning under free trial and had couple of questions.

1) Is VIX option supported? even if I change symbols to just VIX and relax all the parameters it doesnt pick up any trade. I am able to use VXX.

2) Is there a way to create a set of symbols and test various strategies on it.

3) Is there a way to scale trade scan for investment amount. Current scans only show values for one option. Is there a way to to create trades across various symbols for fixed investment of say $3000?

Thanks a lot

Hi!

Thank you for the feedback! These are good questions and ideas. I’ll add them to the requests list and we will look into adding them to our road map (currently working on the stock score and technical indicators)

At the moment we don’t support futures, we do support the ETFs. so in the case of VIX you can use all the ETFs such as UVXY, SVXY, VXX etc.

You can use the ‘add symbol’ filter and copy paster there as many tickers you like. When you activate that filter the results will only be for those filters.

At the moment we don’t have a way to scale trades. We will look into adding it.