Many traders see SPY options strategy as an indispensable tool in their trading arsenal. This article will delve into crucial strategies for day trading SPY options, providing clear, uncomplicated guidance on how to trade SPY options. Whether you’re a beginner or a seasoned trader, these insights will enhance your trading approach.

Key takeaways

- Popular SPY options strategies include Long Strangle, Long Straddle, Iron Condor, and Iron Butterfly.

- Before a major macroeconomic event, you may position yourself with a SPY options strategy benefiiting from high volatility, like a Long Strangle or Long Straddle.

- In a relatively calm market, an Iron Condor or Iron Butterfly could be a profitable SPY options strategy to consider.

Design a Good SPY Options Strategy

A solid SPY options strategy starts with a firm grip on some efficient methods. The Iron Condor, Long Strangle, Long Straddle, and Iron Butterfly strategies are particularly helpful for those looking to day trade SPY options.

The Iron Condor strategy, for instance, is used when the trader anticipates little movement in the stock’s price. On the other hand, the Long Strangle and Long Straddle strategies are beneficial when significant price swings are expected.

Recognizing market trends and volatility is equally important. It helps you predict potential price movements and identify optimal trading opportunities. Remember, a trend is your friend, and understanding volatility can prevent unnecessary losses.

Being mindful of trading hours is crucial. The U.S. stock market, including SPY options, typically operates from 9:30 AM to 4:15 PM Eastern Standard Time. However, there may be pre-market and after-hours trading as well.

Costs associated with trading SPY options include both commission fees from your broker and the bid-ask spread. Always account for these costs when calculating potential profits. A benefit of trading Spy options is that ATM options often trade at penny-wide spreads – making it very liquid and very easy to trade this asset.

Each option contract has a specific expiration date, after which it becomes worthless. So, choose your expiration dates wisely based on your SPY options strategy.

Lastly, consider liquidity. SPY options are highly liquid, meaning they can easily be bought or sold at any time during market hours. However, deep-in-the-money options may have lower liquidity, so be aware of this when making your trades.

Long Strangle

The first strategy we’d like to mention today is the Long Strangle, a powerful component of a comprehensive SPY options strategy. It’s particularly handy when you’re expecting significant price swings while trading SPY options.

In a Long Strangle, you buy a call option and a put option with the same expiration date but different strike prices. The potential for profit arises from a substantial move in SPY’s price in either direction. If SPY’s price rockets, your call option rakes in profits. Conversely, if it plummets, your put option turns profitable.

However, this simple options strategy isn’t without its risks. One possible downside is if SPY’s price doesn’t budge significantly, resulting in both options expiring worthless. That means waving goodbye to your initial investment.

Time decay is another risk that can eat into your profits. As options near their expiration date, their value can shrink, even if SPY’s price moves closer to one of the strike prices. This factor necessitates proactive position management.

The Long Strangle is clearly a versatile tool in your SPY options strategy toolkit, especially useful during volatile market conditions. It offers potential profits from significant price movements, regardless of the direction.

Of course, there is no free lunch, so try to take into account the main market-moving events. If you keep your position open for several days or even weeks, you will face several important macroeconomic events. Therefore, consider the likelihood of negative and positive surprises from these announcements.

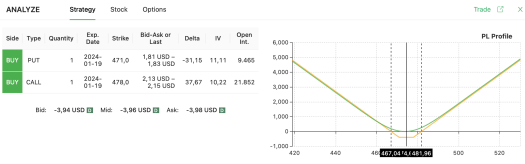

A Long Strangle Example

Given the initial SPY price of $474.60, let’s explore opening a long strangle position. Using our trusty options screener, we find cues to buy a $471 put and a $478 call. In this SPY options strategy, we’re banking on a significant price shift. We need SPY to surge above $481.96 or dip below $467.04.

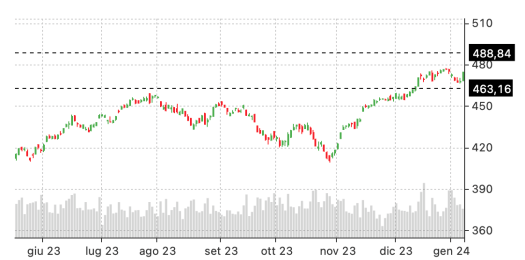

Remember, always scrutinize the price chart of the underlying asset. SPY has been bullish for months but seems to be pausing. Just before we open our position, we spot a large upward swing in SPY prices. This could suggest a possible resurgence of the bull market.

If your assumption holds true, this could be a smart move. It’s a clear example of how to trade SPY options effectively, making it an ideal SPY options strategy for those looking to day trade SPY options in a dynamic market environment.

Long Straddle

If you understand how the Long Strangle works, you’ll have no trouble grasping the Long Straddle, another key strategy in your SPY options toolkit. This approach involves buying a call and a put option with identical strike prices and expiration dates.

The beauty of this SPY options strategy lies in its ability to profit from any significant SPY price movement, up or down. If SPY’s price takes off, your call option gains value. If it dives, your put option will give you a profit. This flexibility makes the Long Straddle an appealing choice for those looking to day trade SPY options (think, for instance, about the days in which the FOMC Minutes are published or a job market report comes out).

The potential for unlimited profit is a major draw. But remember, the Long Straddle isn’t a magic money tree. It requires substantial price shifts in the SPY ETF to be profitable. If SPY’s price stays relatively stable, both your call and put options could expire worthless.

To sum up, the Long Straddle can be a powerful weapon when trading SPY options, especially in volatile markets. Still, it’s crucial to avoid being stuck between the breakeven prices of your options. Once again, the next section will show you a real-life example of how to use this strategy.

Build Your Own Long Straddle on SPY

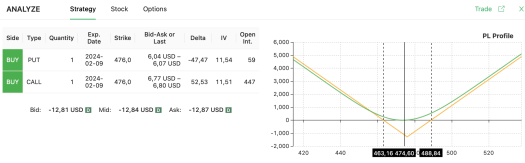

How to trade SPY options with a long straddle approach? Well, if you’re anticipating a trend in SPY prices in the coming days or weeks, a long straddle strategy might be your best bet. This involves buying both a call and a put at the $476 strike price.

For this SPY options strategy to work, you need SPY to either drop below $463.16 or rise above $488.84 by the time your options expire.

Remember our previous Long Strangle example? We noted a significant upward movement in SPY prices the day before trading. This could hint at the start of a new trend phase. If you think this is likely, it’s worth considering this trade.

This is a clear-cut example of how to trade SPY options, especially for those looking to day trade SPY options. It’s a straightforward, no-nonsense approach to trading SPY options in a market that’s on the move.

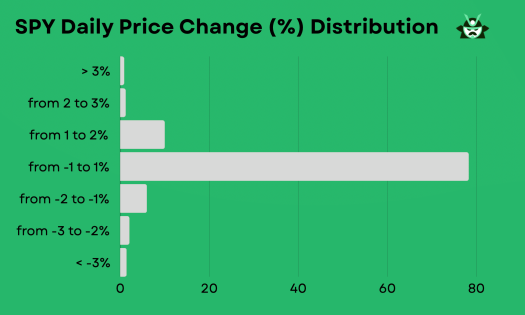

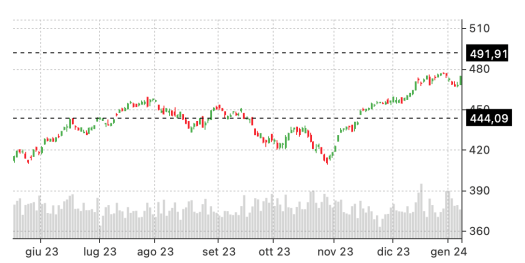

Observation: the SPY Has a Typical Low Daily Volatility

Consider, in general, that the SPY movement will range between -1% and +1% on an average day, as you can see below.

This means that a few “average days” may be sufficient to give you a decent profit (the hard part is to “guess” which days will turn out to be average). As a consequence, while the first two strategies we saw above represent debit positions, the low SPY volatility may push you to consider a credit strategy. Let us see two practical cases in the sections below.

Iron Condor

The Iron Condor is a key part of any SPY options strategy, especially useful when day trading SPY options. This strategy involves combining two credit spreads – a bear call spread and a bull put spread. It’s specifically designed for a market that isn’t expecting big price swings, making it perfect for a range-bound SPY.

One major benefit of the Iron Condor is its ability to generate profit in a sideways market where SPY prices remain stable. This is particularly useful during periods of low volatility or market uncertainty. Plus, this SPY options strategy offers limited risk and defined maximum profit potential, which can be a magnet for risk-averse traders.

However, there are risks to be mindful of with this strategy. If SPY prices move outside your defined range, you will face losses that are great. Also, the potential profit is limited to the net credit received when setting up the trade. This might not stack up to be a lot compared to the potential risk (in fact, speaking of risk, always remember to check out our article on hedge strategy options).

We see the Iron Condor as a valuable tool when trading SPY options, offering benefits in sideways markets while capping risk. Of course, trading close to major economic announcements (e.g., the Federal Funds’ rates adjustment, or GDP data) may significantly move the market, so beware of these events.

Understanding the Iron Condor with an Example

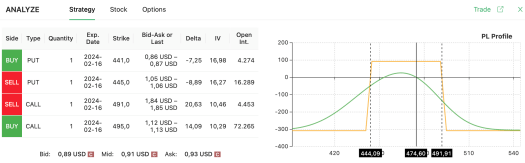

Let’s consider an example to understand the Iron Condor in the context of a SPY options strategy. Imagine SPY is trading at $474.60. In a low volatility period, an Iron Condor strategy can be beneficial. Using an options screener like Option Samurai, you might choose to:

- Buy a $441 put

- Sell a $445 put

- Sell a $491 call

- Buy a $495 call

The goal? To profit if SPY’s price lands within the 444.09-491.91 range by the time your options expire. This SPY options strategy allows you to day trade SPY options effectively, even in periods of low market volatility.

Remember, you don’t necessarily have to wait for expiration. If you’ve made a decent profit in a few days, consider closing your trade early. After all, low volatility phases on SPY typically don’t last long. Trading SPY options in this way may give you a decent profit at a relatively low risk.

Iron Butterfly

The last strategy we’d like to see is the Iron Butterfly, a smart addition to any SPY options strategy. Here, you combine a bear call spread and a bull put spread on the same underlying asset – in this case, SPY options. This strategy comes into play when you expect SPY’s price to hover within a specific range.

One potential advantage of the Iron Butterfly is its ability to generate profit from a limited range of price movement. If SPY’s price stays within your defined range, you’re in for a profit. This strategy shines particularly brightly during periods of low market volatility.

However, it’s not without its downsides. The Iron Butterfly limits your profit potential – you’ll hit the jackpot only when SPY’s price matches the middle strike price of your options. Plus, this strategy involves buying multiple options contracts, which can ramp up trading costs and complexity.

In conclusion, the Iron Butterfly is an effective tool when trading SPY options, designed to turn profits in a stable market. But be mindful of its limitations, as strong volatility may easily put you on the wrong side of the market.

Iron Butterfly: A Realistic Example

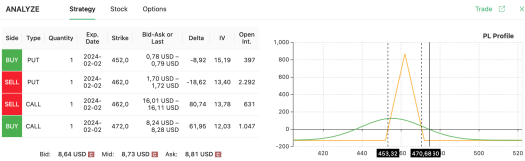

Suppose the recent uptick in SPY prices has you doubting the euphoria and suspecting a neutral or mildly bearish trend instead. In this scenario, our options screener might indicate an iron butterfly opportunity. Here’s what you could do:

- Buy a $452 put

- Sell a $462 put

- Sell a $462 call

- Buy a $472 call

This SPY options strategy would need the SPY price to be between $453.32 and $470.68 when your options expire. Your maximum profit would occur at $462. Essentially, you’re hoping for SPY to edge closer to $462 and hover around that price.

Predicting the exact SPY price on expiration day is challenging, so it’s likely you’ll close this position before expiration if you see a good profit. This is a practical example of how to day trade SPY options and a solid part of any SPY options strategy.

So, which SPY options strategy should you choose? Definitely go for a Long Straddle or Long Strangle when you expect a significant macroeconomic event or market catalyst to drive a substantial SPY price movement.

The Iron Condor, instead, is a great strategy to use in low-volatility markets, when you expect SPY’s price to remain within a specific range. The Iron Butterfly adds a twist to this approach and can be used in similar market conditions, but you’ll need the SPY price to be close to a specific value.