Trading Earnings Announcements

| Importance: | Medium | |

| Execution: | Hard |

Earning announcements trigger high volatility in stocks every 3 months. On the weeks prior to the announcement date we see substantial increase in IV. However immediately after the earning announcements the IV tends to drop (often more than 40%). To profit from this many traders sell options to enjoy from the volatility drop that happens after most of the uncertainty disappears.

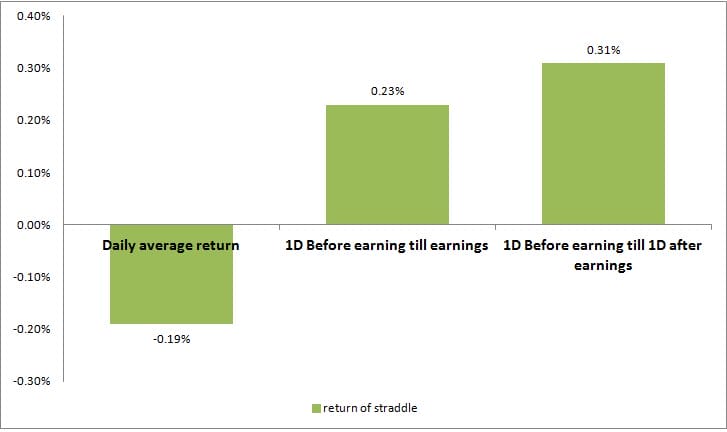

In the article: “Anticipating uncertainty: Straddles around earnings announcements” the authors show the daily return of straddles (Short put and call on the same strike and expiration) on “regular” days and before earning announcements:

We can see that even though the IV rises before earning announcements – the market often under-estimates the stock movement caused by the announcement. This doesn’t mean we can’t profit when selling options. We just need to use caution and find the best opportunities.

Finding earning trades in Option Samurai:

Some tips when trading earning announcements:

-

Prefer Selling options – the volatility drop will usually be too violent to profit with long options.

-

IV rank extremely high

-

I prefer trading few days to expiration.

-

Trade strangles (Sell options Out The Money) – I usually prefer selling both sides.

-

Break even point for the position should be near support or resistance level

-

Have a game plan before setting up the trade – it is better to know what you want to do before “bullets” starts flying and everything is happening. For example: What do you expect from the earnings? what happens if you are breached? do you want to hold it long-term? etc.

-

Don’t have to trade – If you don’t find a trade you like. Don’t compromise – you’ll have more chances.

Read more: