Options have inherited strengths compared with vanilla stock positions, and it’s important to play to those strengths and try to minimize exposure to the weaknesses. This is the first part of a series where I’ll elaborate on trading leap options’ strengths.

I wish to suggest a straightforward strategy to increase profits while minimizing risk. The process is simple – it merely requires buying a leap call to take advantage of an expected rise in stock prices (Options as stock-replacement). The call serves as a leveraged equivalent of buying 100 stocks. If you keep that ratio – 1 option = 100 stocks – the maximum loss is lowered, even if the position is leveraged.

Barron’s Round Table

To simplify the stock selection process, I will take a list from the financial media – this case, Barron’s newspaper. The stock selected is important, but for this example, I want to show that even with a list from the financial media – The edges provided by the leverage, stop loss, and diversification of the options is enough to give us great returns.

At the start of 2013 (and the beginning of 2014), Barron’s sat down with several very successful investment professionals to a round-table discussion on which stocks will outperform the following year. The article itself is locked for subscribers only, but the magic of Google will let you find what you want. This is the most recent round table.

Trading Leap Options

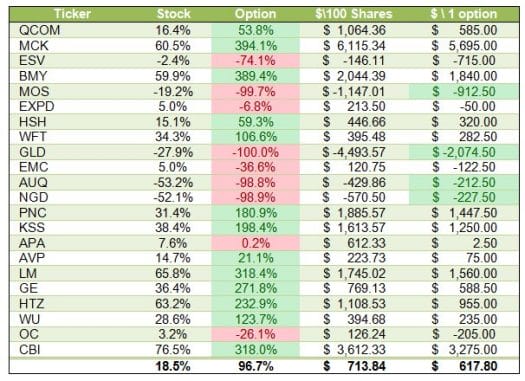

In this example, I used the round-tables 2013 recommendations. I took In-The-Money LEAP calls that were at least 10% ITM and expired one year later – in Jan 2014. We had 22 optionable stocks to check out of 43 recommendations (today, we have more optionable stocks). In the backtest, I “bought” the options on Jan-11 2013 and “sold” them on 31-Dec 2013. For comparison, I also checked the stock yield for buying 100 stocks of each ticker. Here are the results:

- We can see that the recommendations were successful, yielding 18.5% percent for the year.

- The Options were much more leveraged; they yielded almost 100% for the year.

- The average $ profit of stocks ($714) is higher than the average $ profit of an equivalent option position ($618). This is mainly due to the time value inside the option that decayed as the year passed.

- Even so – It’s Important to remember that the average stock position was 6.25 times bigger than the option position.

- The fact that the option position is smaller than the stock position but yields almost the same results is often used to increase leverage. Often It’s better used to diversify the portfolio over leveraging it.

- Because options have limited loss but unlimited gain potential, we can see that in 4 trades, the option lost less in dollar amount compared to the stock.

Key takeaways

- Leap options can be good replacements for stock positions. The limited loss, and unlimited profit potential are great when you expect great stock movements.

- Options are leveraged instruments. We can see an example where the stock lost 2.5%, but the option lost 75%. Manage risk first.

- We can see the real upside of holding diversified positions of leap calls where they gained an average return of almost 100% when the average stock return was 18.5%.

How to Find Leap options to trade

You can use Option Samurai options screener to scan for leap calls to trade. Simply change the expiration date and the stock score and sort the columns to find trades:

- How to find leap options on Option Samurai

- How to find weekly options that will explode in value (this is a practical example of how to use the scenario engine, you can adapt it to use for leap calls)

- You can find an example trade we did on $VZ.

(Publish originally on Mar 15, 2015, and updated since)

Holding an option through the expiration date without selling does not automatically guarantee you profits, but it might .

Agreed. I usually sell (or cover) the options before expiration. However when running tests, it is easy way to test an edge. When you trade it, I would recommend to see what is the ideal moment to roll the options