Earning announcements are probably the most important corporate action for a public company. Due to the uncertainty of the announcement, the expected (and realized) volatility during these times is unusually high. Looking at the options market, we see Implied volatility rising substantially before earning announcements and dropping violently after (touched about it briefly here). In this post, I wish to talk about trading earning announcements with options. First, let’s talk about how not to trade earning announcements.

How NOT to trade earning announcements with options

Don’t sell straddles.

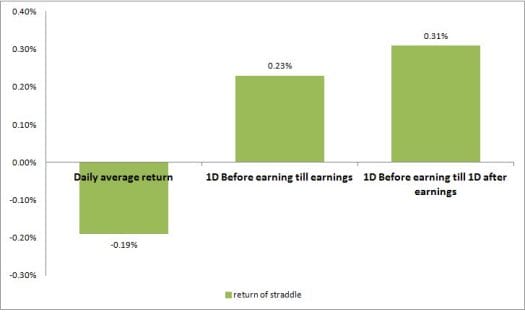

Many academic studies were conducted in order to gauge the effect earning announcements have on stock performance. One of those studies (here) Checked the performance of buying straddles (buying call and put options on same strike and expiration) 1-5 days before earning release till the earning day or a day after. The researchers found that buying straddles ahead of earnings yields a positive return (before friction). The results are:

- Robust for different time frames, implied volatility, company size and more.

- Stand in contrast to the fact that buying a straddle, not before earnings will usually cause losses.

- Don’t include friction (bid-ask spreads, commissions, and tax) so can’t be copied in real life.

It is important to note that the research was conducted on buying straddles. Since most professionals sell straddles we need to reverse the results to see their edge. This article strengthens the “common wisdom” in the market – Selling straddles will usually lead to profits, but not before earnings.

How TO trade earning announcements with options

- Trade outside of money – As you can see, the edge in buying straddles for expiration is very small and practically disappears when adding frictions. You might be able to enjoy the effect of the volatility crush when opening positions out of the money.

- Don’t Trade automatically – Options are priced correctly for the most parts. Trade where you think you can have a bigger edge – you know the stock, you want to hold it, you have an opinion about its (relative) worth, etc.

- Have scenarios – Though there is high uncertainty, try to build different scenarios (game plan) and execute it during trading. When you have time to plan your actions, you’d probably going to reach better decisions than during trading when ‘bullets are flying’.

- Short time to expiration – Volatility crush will be the most violent when there is no time till expiration and the option is out the money. To capitalize on it, look for the closest expiration possible to earnings.

Example: Trading $TSLA Options for earnings announcement

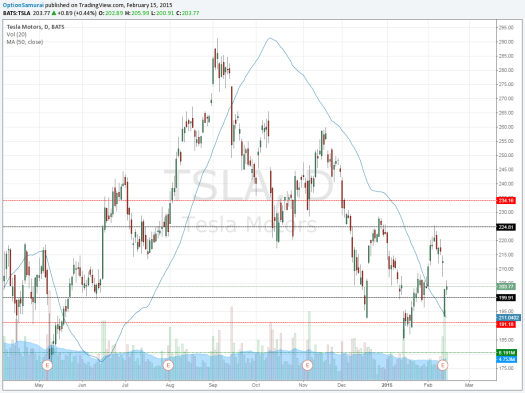

$TSLA needs no introduction for most traders so we’ll jump right in. TSLA announced 11th Feb after market close. I was expecting positive reports (I was wrong) but I liked the stock position technically:

I liked that the stock is in a downtrend in the mid-term. Also, It looked to me as 185~ is a support area and that there are resistances in 225, 230 and 260~

I thought that If the stock gapes down I will roll the put longer or get assigned and sell covered call (I’m long-term bullish on the stock). If the stock gapes up – I’ll roll the position out and up and wait for a correction to close the position, even with a loss.

I decided to go close to the money, but this could have worked with further out of the money options too (and probably fewer heart attacks). I sold put 200 and call 225 for about $9.2~ (black lines)

Though I’d start losing money below 200 and above 225, My break-even points were $191&$234 (red lines). When the stock open under 200 I waited, and the stock enjoyed a bullish trend during the day. Before the close I closed the position for about 1.1~$ – I didn’t see any value in continuing holding this position any longer.

How to find earning announcements Option trades?

In OptionSamurai scanner you can search for earning announcements trades:

- Press on “Add filters”

- Search for “Earning date” and select it

- On the filter panel press on the earning date value (default is “any”)

- Select your preference (before or after)

Sign-up to Option Samurai for free