This is the third installment in our series into the edge of selling options. You can see the previous two parts here and here. Most of you probably noticed that in one of the researches we mentioned last post – The strategy that performed the best was selling naked puts:

(The article: index-option-writing-ACG-Feb-2012)

We can see that an index based on selling cash-secured puts and investing that cash in t-bills is the best performing strategy – both in return and in volatility.

Why sell puts?

As we said last time. We get the premium upfront, and then as time passes we generate profit as the option premium is worthless. We can also see in the article above that the naked put strategy outperforms the buy and hold of the S&P and also other options strategies – namely covered call strategy which provides identical P/L scenarios.

If we check the distribution of monthly return we can see that selling puts have a much more consistent monthly return and less extreme monthly returns.

The consistent and positive return of the strategy helps the strategy to outperform the market.

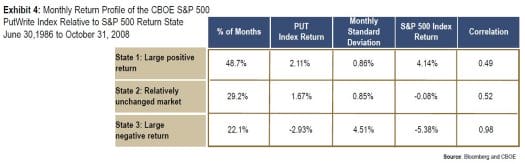

Another in-depth look into the performance showed that the strategy performance was good even in different market states:

We can see that while the S&P outperforms the strategy during strong bull markets, it underperforms in both bear and side-way market. Together, sideways and bear markets consist of more than 50% of the time. This gives an additional edge to the strategy.

While it is logical that the strategy would under-perform in bull markets (the profit is capped) and over-perform in sideways market (profits from time-premium) – It is NOT intuitive that the strategy out performs during bear markets as the common convention is that bear markets are dangerous and volatile.

There are several reason for the edge of selling puts:

- Many market participants see puts as insurance and are willing to pay more than the ‘fair’ price for protection. Then, even if market crash, you are still “better off” then buy-and-hold.

- While the movements are more volatile on the downside, the options usually price this risk and the IV rises when the traders anticipate a crush. This allows us to roll and sell new puts for a higher premium and gain more protection.

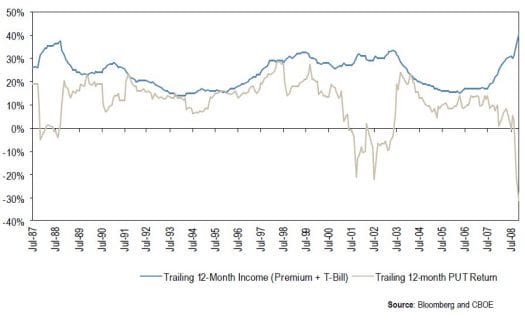

- The strategy was created so the cash to secure the put sell was invested in T-bills. This allowed for another source of income and it also has low correlation to the market. The following chart shows the return of the cash secured put VS the put sell itself:

We can see that the cash in T-bills provided extra protection and decreased volatility due to the low correlation and volatility of the T bills. Today the yields are low in T bills so there won’t be much difference, but if we invest the cash in assets with low correlation and low volatility we might be able to replicate the results to some extent.

That last chart also explains why this strategy out-performs the covered call strategy – The T-bill interest has low correlation to the market and provides the extra ‘edge’ the covered call was lacking.

Tips for selling naked puts:

- The higher the Implied volatility percent rank is better.

- Don’t hold the position during earning announcements.

- Sell meaningful premiums (~$1). This will increase your chances for profit as you can roll the position or close it early.

- Close the position early when achieved 80% of potential profit or if option is worth 5-10 cents.

- Sell options Out of the money – easier to capture theta, and allows you to buy the stock for a cheaper price. You can use our probability scanner.

Try Option Samurai

- Use our naked put screener to find trades fast.

- Read more in the article PUTIndexEnnisKnupp

- Use our pre-defined screens to quickly discover the best trades.

(Originally written in July 2015 and updated since)