Many of the trades we take here at Option Samurai involve using dividends (And also buybacks, but this will be covered in a future post). We often use covered calls for dividend capture and we also hold some positions for longer periods of time and lower our cost basis with dividend and option premium (example on BX).

We often scan and use dividend stocks as research shows that they tend to be more stable companies and outperform the stock market. This is especially true when compared to stocks that don’t distribute dividends.

The Edge of Dividend Stocks

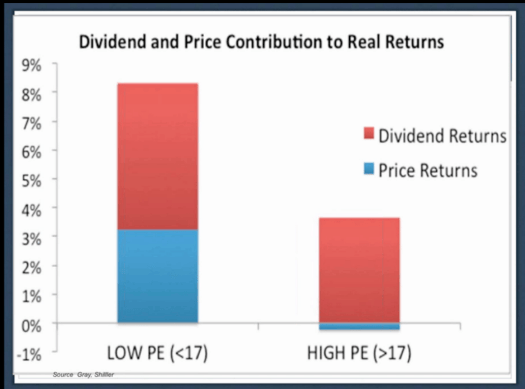

Many studies were conducted on dividend investing, and all showed different levels of outperformance. In the (highly recommended) book “Shareholder Yield: A Better Approach to Dividend Investing,” Mebane Faber shows the following chart, illustrating that dividend is responsible for all of the yield in expensive stocks, and most of the yield in cheap stocks:

We can see that for cheap stocks (PE smaller than 17), the price appreciation was responsible for about 3%, while dividends were responsible for about 5%. For expensive stocks – we can see that the price means reverted and hurt the investor’s yield. But dividends still provided almost 4%, so the investors showed positive returns.

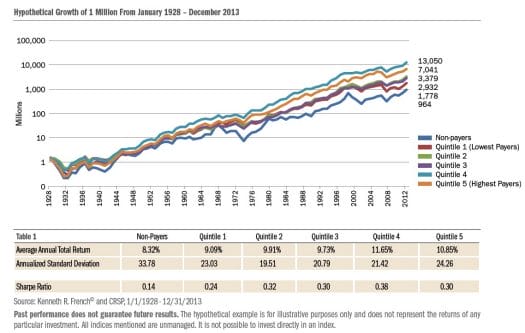

When comparing dividend stocks to the general market, we can see that dividend payers outperformed as a group non-payers:

Source: Dividends: Review of historical returns Heartland Funds

In the above chart, we can see that dividend payers outperformed non-dividend payers. The test was conducted by building 6 portfolios: 5 dividend portfolios, each holding 20% of the stocks according to dividend yield (so quintile 1 is the lowest dividend yield and quintile 5 is the highest) and another portfolio for non-payers.

We can see that high yield, but not the highest, performed the best (quintile 4); this could probably be because the highest quintile has a high percentage of companies that would not be able to sustain the dividends, and the market already adjusted their price.

How can we use dividends in options trading?

Since research shows dividend stocks outperform non-paying stocks and the general market, how can we profit from this with options?

When stocks distribute a dividend (during the Ex-date), the price is adjusted, but the option price is usually not adjusted (We will cover when the option price does adjust in a future post). For example, if stock XYZ price is $100.01 and it distributes a 5$ dividend:

- The Adjusted stock price will be $95.01.

- This means that Call Strike 100 is suddenly out of the money, and

- Put strike 100 is suddenly in the money.

If we connect these two facts, we can see that the put options’ price should rise after the Ex-date, and the call options’ price should decrease. This means we could profit from strategies like covered calls or married puts – strategies that are bullish and will profit from the expected price movement.

It is important to note that option pricing often reflects the price adjustments. This is why it’s important to use a scanner that helps you find all the trades so you can find the trades where you can profit even with those changes. We will show an example of option pricing vs. dividend date in the future.

How to use Option Samurai to profit from dividend stocks

There are several ways you can use our options screener to find the best dividend stocks and option plays:

- Custom scan with dividend yield: You can scan all strategies (not just covered calls or married puts) and use the dividend yield scanner to filter results with a certain dividend yield:

- Custom scan with payout ratio: You can also scan for a payout ratio in order to verify that the dividend is sustainable or reverse the scan and look for a high dividend yield with an extremely high payout ratio – hinting at the fact that the dividends might not be sustainable. You can add the payout ratio scanner similar to the dividend yield scanner above.

- See only trades with ex-date before expiration – You can scan for trades where the Ex-date is only before the expiration, and thus make sure you gain exposure to the dividend event:

Summary and key takeaways:

- Dividends are a bullish trigger – Research shows dividend stocks outperform the market, so we should usually look for bullish trades. We can see an out-performance of 0.77%-3.33%.

- Option strike doesn’t re-adjust on Ex-date – We can profit from this – especially with selling calls and buying puts.

- The easiest way to profit from dividends stocks during the dividend Ex-date would be covered calls or married puts: These are bullish strategies that will profit from the fact that the strike doesn’t adjust during the Ex-date.

- You can use the dividend capture predefined screen to find trades quickly or use the custom scanners to find your own trades.

Read more about Profiting from dividends with options