Many traders ask themselves how much the Implied volatility drop after earnings. Since earning release are very volatile – We can see an increase of IV in the month(s) leading up to those dates. After the earnings release the certainty increases and Implied volatility drop.

The question is how much the implied volatility drops?

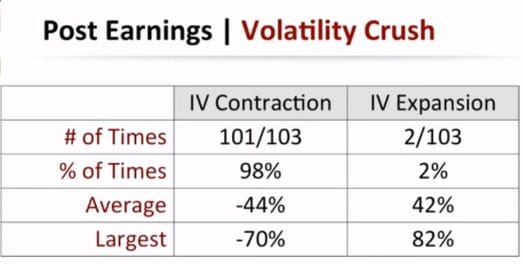

The guys at Tasty trades did a test for the 4 last earning releases on 27 liquid stocks that they trade. Overall, 103 occurrences. They find that:

- 98% of the occurrences the volatility dropped right after earning

- The average drop was -44%

The following chart displays the average drop per stock, and how liquid the stock is (measured by a 10-day moving average of option volume. ) The chart is colored and sorted from largest decline to the smallest decline:

Though the connection is weak, we can see a connection between option liquidity (contracts traded) and the implied volatility drop after earnings:

In conclusion:

Implied volatility crushes after the earnings release. This occurs because: (1) The IV have risen ahead of earnings and (2) cause there is less uncertainty in the pricing.

It is usually extremely hard to profit from this, unless you have a directional bias, And I will expand about this subject in the future.

If you wish to find trading opportunities, you can use Option Samurai scanner to do so. Even the free demo. Here is a gif explaining how:

- I’ve used Calls just for continence – you can search for puts and credit or debit strategies – The idea is the same.

- Make sure you look your expiration date and moneyness filters are set to your style. You can adjust the stock score to limit results further.

- From the “earnings date” filter choose – “before expiration”. Now you will see only trades that have earning releases before expiration.

- You can also scan according to Implied volatility rank to limit results further and save time.

Try us out! sign up for a free trial.

(Originally published on Jan 2105, and updated since)