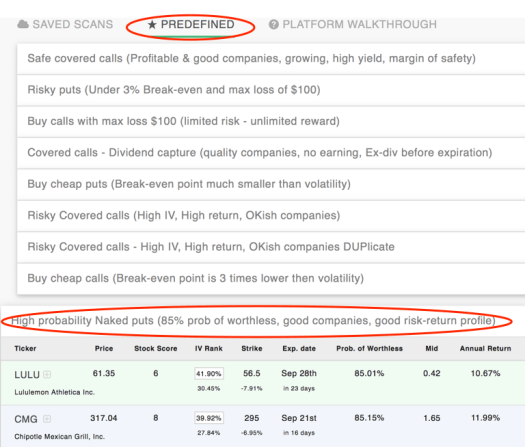

We are going to see how to choose an option for selling using a predefined scan. In this case, we’ll use the “High probability Naked puts (85% prob of worthless, good companies, good risk-return profile)” scan.

The current low volatility market environment is conducive to writing puts, which are a neutral to bullish strategy.

You can access this scan by going to Predefined Scans, the click the above naked puts scan, as shown in the screen shot.

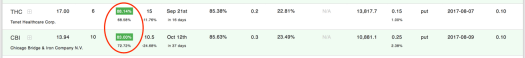

Several options will be displayed. We are looking for an option with High “IV Rank”. IV is implied volatility and is ranked from 0 – 100. It’s a comparison of historical volatility with current volatility.

We can see both THC and CBI have IV Ranks over 80%, as shown in the screenshot below. We’ve quickly narrowed our choices down to only two options at this point. Looking at “Prob. of Worthless”, which is the probability of these options expiring worthless, they are both over 85%, giving us some great odds of capturing full premium.

Next, we check Annual Returns, which are both close to each other and over 22%. So far so good. But we need a deciding factor when choosing one of these options over the other.

That factor in this case is Stock Score, which is an overall ranking of stock quality. It ranks from 0 – 10. CBI has a rank of 10, which easily beats out THC’s rank of 6. Let’s take note of how that helps us in the case. Up to this point, most parameters we’ve seen between these two options have been almost the same. Now we’ve found a reason to choose CBI over THC.

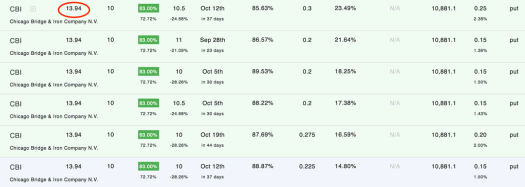

Click the Price (circled in the screenshot below) on CBI to open up its options chain.

Looking through the chain and specifically the Annual Return column, we can see that 23.46% is the first option in the chain and also the highest return. If we write a put on the Oct 12th 10.5 strike, which is a weekly option, with a bid of $0.25 and hold until expiration, we have an 85.63% chance of capturing the full premium.

Looking all the way to the right under “Earn. date”, we can see that earnings were on 8/9/17. Knowing earnings have already passed means they won’t be a concern if we hold until expiration on Oct 12th.

Let’s discuss how the current market environment factors into our decision to sell puts. While higher overall market volatility would be great for put premium capture, it doesn’t mean we can’t find opportunities for writing puts.

With a low volatility market, the risk of large gyrations in our stock has mostly been removed. This reduces the risk that the stock will drop below our 10.5 strike. We can see that CBI’s stock is currently at 13.94, giving us a 3.44 cushion (almost 25%).

Besides observing market behavior, we can also further verify low market volatility by observing the VIX’s current price of 11.56.

With a .25 bid on this contract and possibly getting a midpoint of .30 (since the spread is listed at .10), there’s a high probability to capture $120 with only 4 contracts on this option.

Using predefined scans can help get you off and running quickly when you have a good idea of the type of option strategy you want to utilize.

Click here to go to Option Samurai scanner and find similar trades instantly.