Category: Tutorials

Reverse DCF Option Strategy Excel Template – Back Your Trading Decisions with Data-Driven Insights

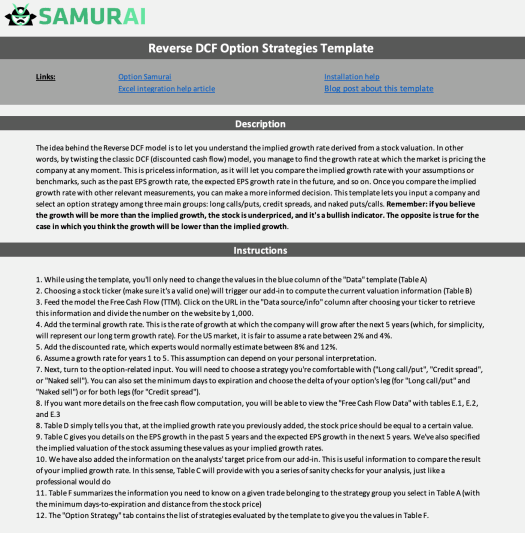

Backing your options trading with a fundamental analysis can give you an edge in the market. You can achieve this result in only a…