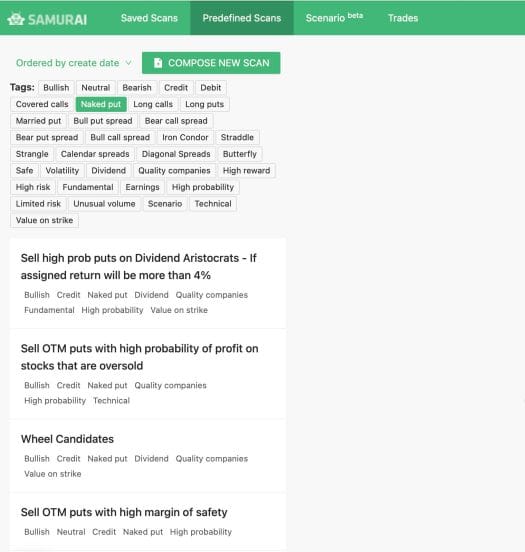

Category: Selling premium

When to Sell an Option? A Look at Market Scenarios

If you’re wondering when to sell an option, our guide will shed light on complex market scenarios. When should you sell your options and…

Exploring the Strategy of Selling Options After Hours

You may have heard that some brokers allow you to trade options even in the after-hours session. While this is a possibility, there are…

Harnessing the Potential of Options Selling: Tips and Strategies

Among the many strategies in the stock trading universe, options selling reigns supreme. This article demystifies how to sell options, when to sell an…

The Basic of Selling Options on Expiration Day

If you’re wondering about selling options on expiration day versus exercising them, this article is for you. We’ll delve into whether an option can…

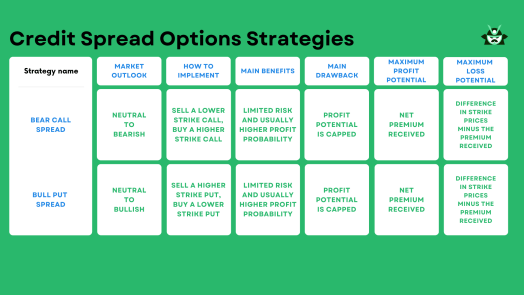

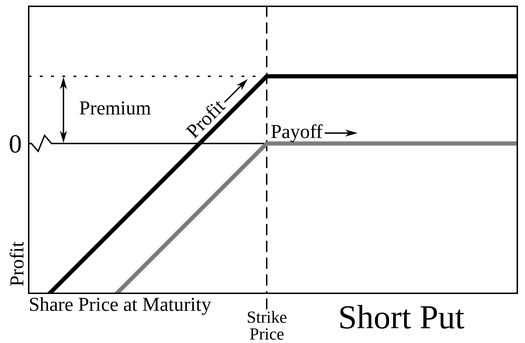

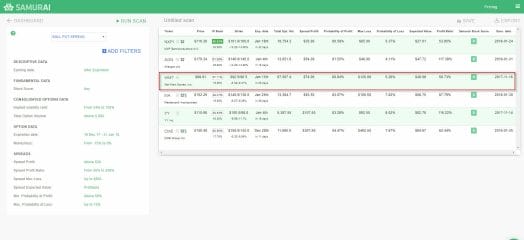

Selling Call Spreads: A Comprehensive Dive into Bear Call Spreads

Among various options strategies, selling call spreads, particularly bear call spreads, stands out. This article provides a deep dive into credit call spreads or…

A Comprehensive Guide to Options Selling Strategies

Selling options can seem daunting, but our comprehensive guide to options selling strategies simplifies it. Whether you’re exploring the best option selling strategy or…

A Deep Dive into Selling Option Premium for a Living

Dive into the intriguing world of selling option premium for a living. This comprehensive guide will explore how selling premium options can yield consistent…

The Wheel Options Strategy: Your Comprehensive Guide to Steady Income Generation

Options traders, from beginners to seasoned veterans, seek a methodical approach that delivers consistent income while managing risk. This is where the Wheel Strategy,…

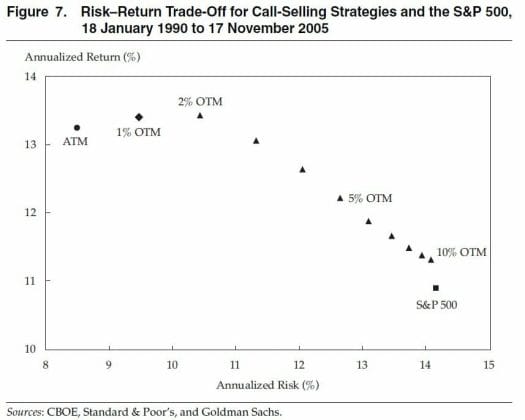

Picking the perfect covered call strike

Covered call is one of the most popular options strategies. Last week we mentioned that option-sellers have an edge when trading, and we talked…

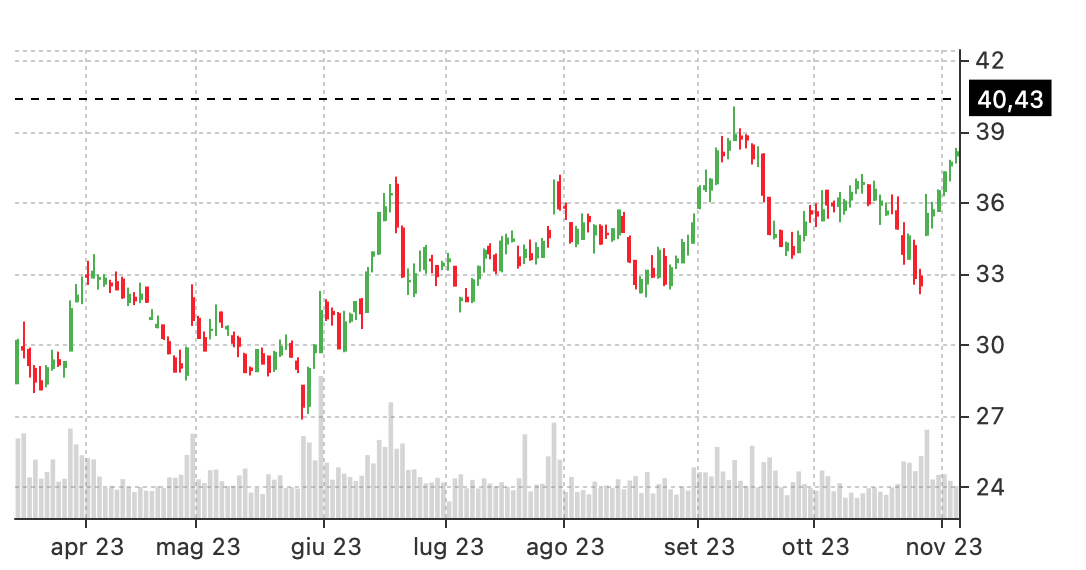

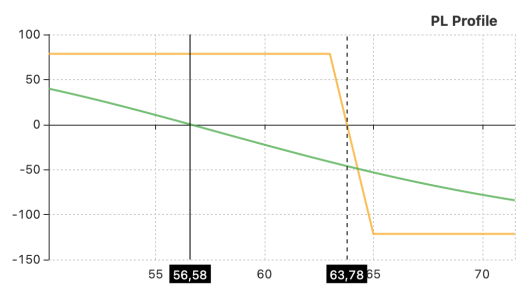

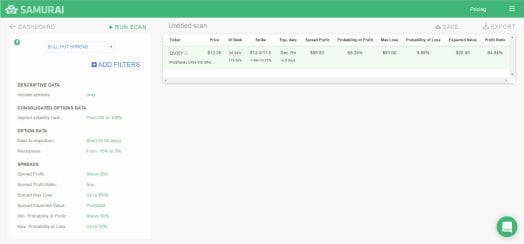

Bull Put Credit Spread on $WMT

The holiday season is coming down the back stretch and this year looks like it will be a winner. According to the CNBC All-America…

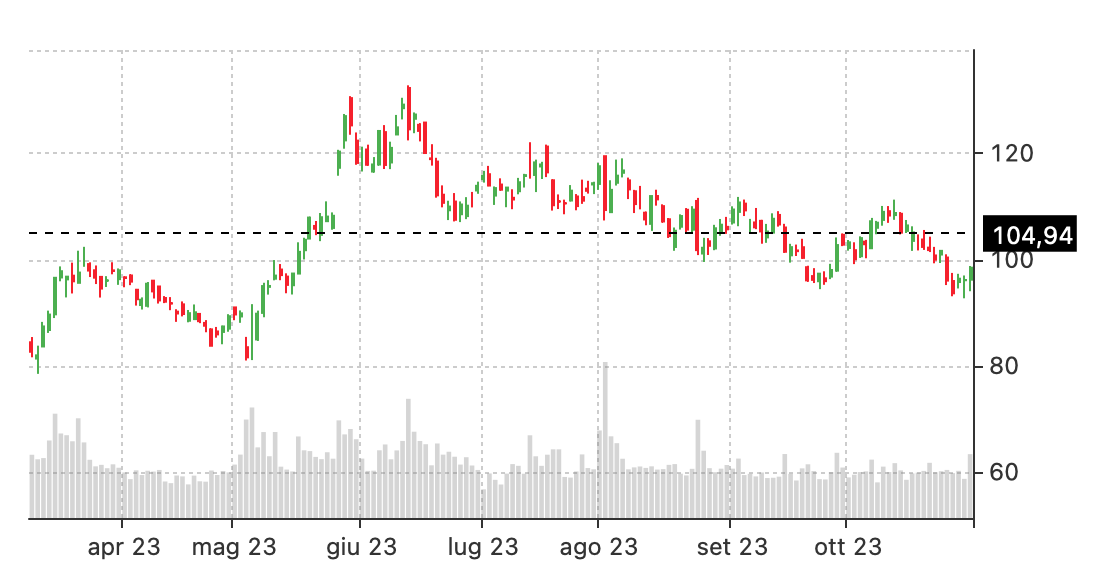

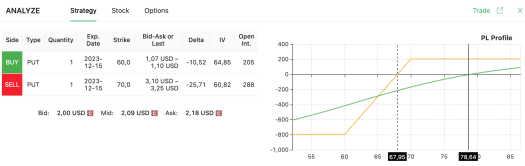

Bull Put Credit Spread Trade ($UVXY)

The major indexes continue to hit fresh all-time highs as the calendar flips into the last month of 2017. The combination of robust earnings,…