Category: Research

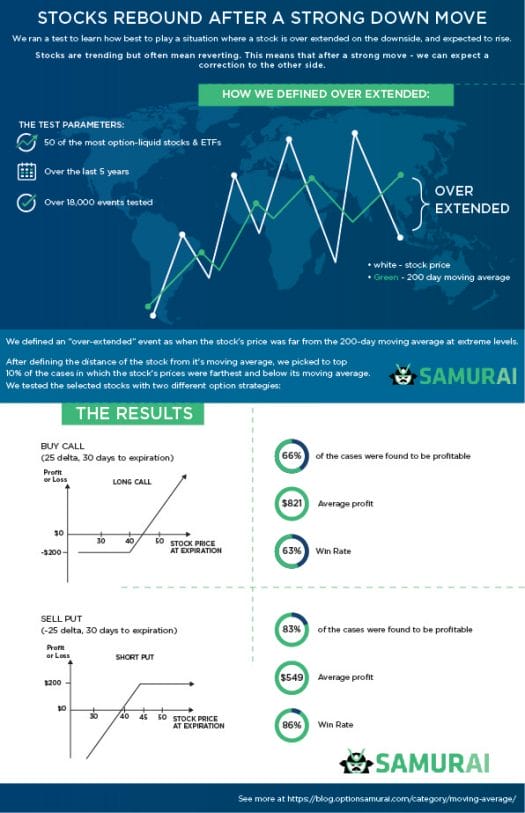

How to trade when a stock is over extended

As traders we are constantly on the look to understand the market’s tendency and how to act on it. One way is by examining…

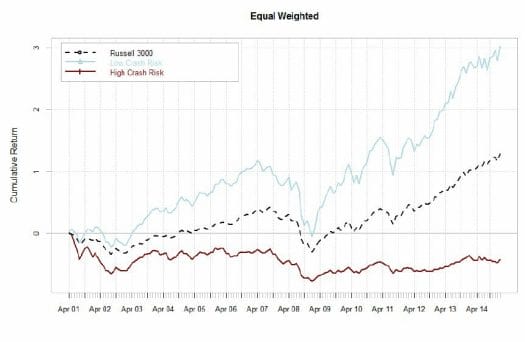

The edge of relative strength – Risk on / Risk off

Traders that trade with the trend, increases their chances to be profitable in the long run. While it is impossible to completely predict the…

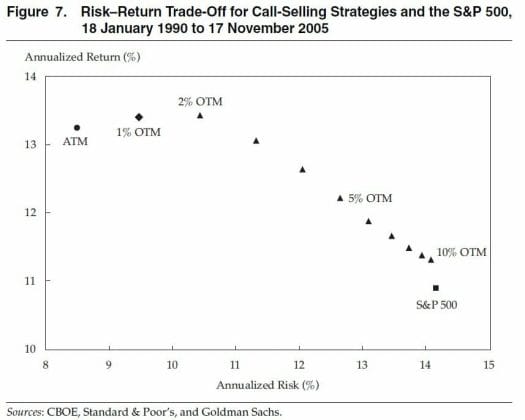

Picking the perfect covered call strike

Covered call is one of the most popular options strategies. Last week we mentioned that option-sellers have an edge when trading, and we talked…

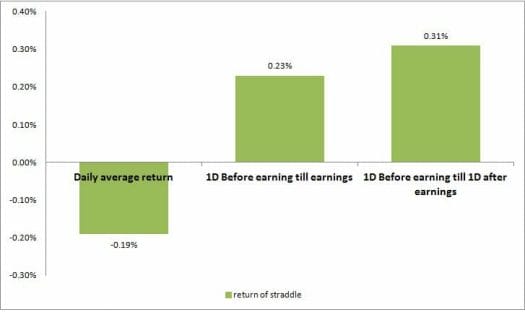

The Edge of Option Selling – Part 1

Option trades can be either an option buyers and enjoy unlimited profit potential and limited risk, or be an option sellers and enjoy higher…

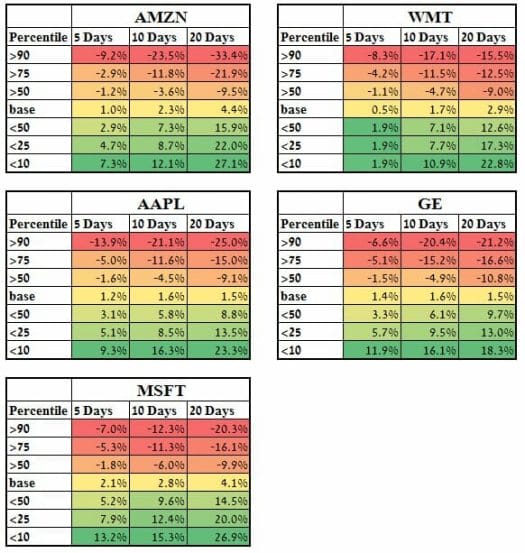

Edge of Skew Rank – Part 2

In the last article, Volatility Skew Rank – Part 1, we talked about what skew is. In this article, we will talk about ranking…

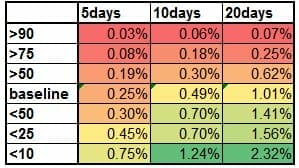

The Edge of Implied Volatility Percentile

Implied volatility is one of the most important concepts in options trading. This is the measure most market players use to check if an…

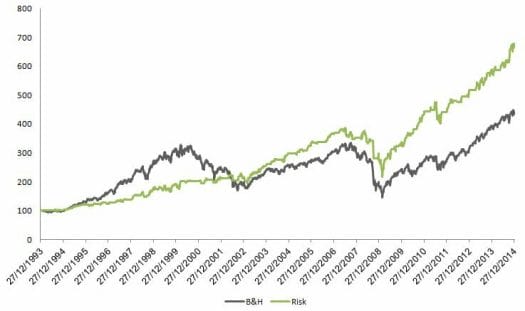

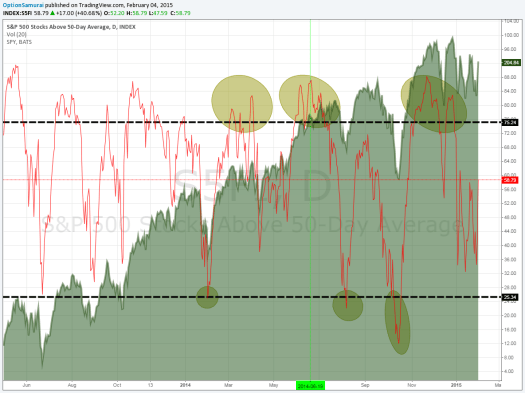

The edge of market Breadth

This is the third part of our in-depth look into the various edges traders base their decision making . You can read the previous part…

Trading Implied Volatility – Part 2

This is the second part of a four (very important) part post about how to better trade implied volatility. Most sources (educators, websites, etc.)…

Trading Implied Volatility – Part 1 – Predicting stock movements

Predicting stock movements is the holy grail of investors, and many studies, tests, and systems have been developed and are being developed to do…