The holiday season is coming down the back stretch and this year looks like it will be a winner. According to the CNBC All-America Survey, average holiday spending intentions will top $900 for the first time in the 12-year history of the poll, which is the widest margin on record.

CNBC conducts a survey of 800 Americans and found a surge in the percentage of Americans planning to spend more than $1,000, which is up to 29% from 24% in 2016. The margin of error according to CNBC is slightly more than 3%.

To take advantage of increasing holiday spending, traders are buying Wal-Mart ($WMT)and with implied volatility stable using a bull put credit spread, is a prudent way to generate revenue by betting this retail giant will experience a banner year.

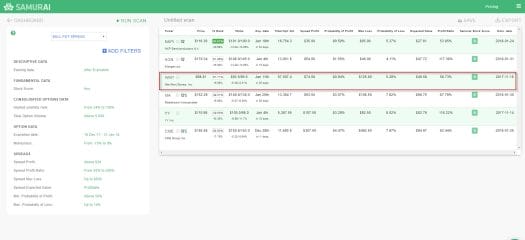

You can now easily scan for option spreads using Option Samurai. Just as a refresher, a vertical option spread strategy is one where you purchase and sell two alike options (either 2-puts or 2-calls) simultaneously, that have the same expiration date. The only difference between the options will be the strike price and the premium. A vertical option that is a credit spread allows the seller of the spread to receive a credit, which means the premium of the option you sell is higher than the premium of the option you purchase.

When you look to sell a bull put credit spread, you are betting that a stock will not drop through a specific price before the expiration date. This means it can go lower or higher but will be a winner if it remains above a specific level. The price level you want to avoid is the sold put price, but even if the underlying stock declines below this level you can still make money.

Running an Option Samurai Scan

There are several criteria that are key to finding a robust Bull Put Credit Spread

The Option Samurai Scan can include any symbol, but in the case of a stock you want to make sure the earnings are after expiration. You also want to make sure that the implied volatility that is priced into the vertical spread is at least above the lower quartile of its historical range. You can do this by making the implied volatility range in between 25% and 100%. If you want an out of the money bull put credit spread, make the range of “moneyness” less than zero.

The spread profit describes the amount of profit you would receive if you executed 1-contract of a WMT bull put credit spread, and both options expired worthless. You can construct this by using the spread profit above a specific level. The spread profit of $74 means that the price of the sold put (in this case the $92.5 put) minus the price of the purchased put (in this case $90.50) is $0.74.

Since the strike spread ($92.5 – $90.50) equals $2 and the premium you would receive is $0.74, the max loss is $1.26 for each contract or $74 for one contract of $WMT. You can alter the Max loss to make sure you only find spreads that have specific risk parameter.

Lastly, you want to make sure the spread expected value is profitable, or a specific minimum. Spread Expected Value, is a statistical measure that tries to predict the profit or loss of the strategy. It is calculated as the sum of all possible values each multiplied by the probability of its occurrence. The scan will also describe the profit ratio, which is the return you will receive if both options expire worthless.

The trade:

- Sell WMT January 11, 2018 $92.50 Put at $0.90

- Buy WMT January 11, 2018 $90.50 Put at $0.16

Your potential gain on the trade is $0.74. You broker will request margin of #contracts * 100 * ($92.5 – 90.5 + $0.74) or $74 per contract. Your return if both options expire worthless is 58.7% ($74/$1.26).

Your maximum loss is the different between the 2-strike prices ($2) minus the premium, = $0.74 or $126 per contract. Your breakeven level is $91.76 = $92.50. (short strike) minus premium of $0.74.

Alternative, you could also go to your dashboard and look for alternative but put spreads, using this scan as a guide.

Go to Option Samurai