Selling Options

| Importance: | High | |

| Execution: | Medium |

Option sellers enjoy high probability of profit but limited profit potential. The higher probability of profit is derived mainly from the time premium in the option – which shrinks as time passes. While we can’t predict the future move of an underlying, we can guarantee that time will pass. Since option sellers profit with each passing day (as the time premium shrinks) that increases their chance of profit (especially if they close the trades early). You can say that they profit “unless” something happens, while option buyers will profit “only if” a scenario happens.

There is overwhelming research showing that option sellers have an edge. However – It is very important to remember that options are usually priced correctly and you will need to have a bias on the stock in order to profit from the trade (it doesn’t matter how you analyse the trade, as long as you have a firm believe and a way to track and correct your assumptions).

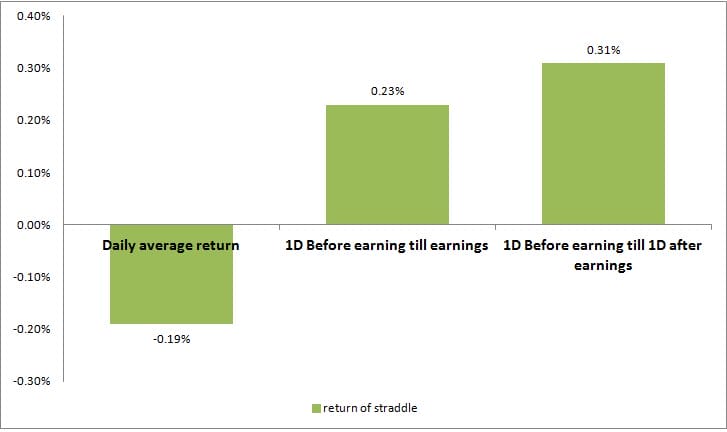

Avg Straddle Return – Regular Vs before earnings

In the article “Anticipating uncertainty: Straddles around earnings announcements” the authors show the daily return of straddles (Short put and call on the same strike and expiration) on “regular” days and before earning announcements.

-

We can see that buying straddles lead to a loss of 0.2% per day (seller profit that) on a ‘regular’ day.

-

Buying straddles profit during earnings, so it is usually best to avoid holding short option positions during earning announcement.

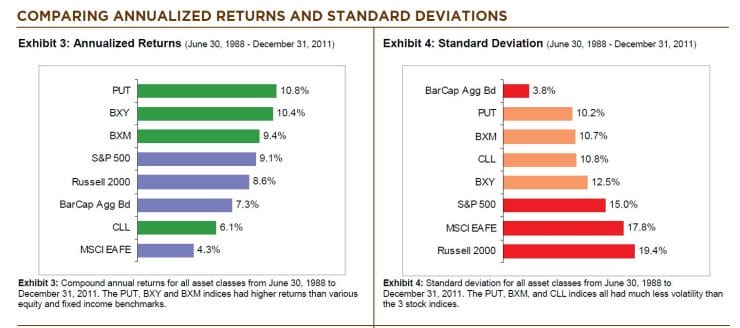

More studies were done on the CBOE indexes that correspond with options strategies, such as: covered-call index ($BXM), covered-call-2%-OTM index ($BXY), naked-put index ($PUT). Those studies showed that the strategies (such as covered call and naked put) outperform the market AND with lower volatility. The following exhibits are from research by Asset Consulting Group:

CBOE Option Indexes

Highlights:

-

Cash secured naked put showed the highest return and lowest volatility (the cash was invested in T bills and was the ‘secret’ of the excess return).

-

Out-of-The-Money (OTM) Covered call was the second highest return but the highest volatility compared with the option indexes (still lower volatility than the S&P)

-

‘Regular’ covered call outperformed the S&P and with lower volatility.

Tips when selling options:

-

The higher Implied Volatility rank the better.

-

Don’t hold the position during earnings

-

Sell meaningful premiums (at least more than 0.5$):

-

If you sell low premium and you are wrong – the lost generated will be too high to cover by other trades

-

The bid-ask spreads will make it had to close the trade

-

-

Roll or close the trade if you managed to gain most of the potential profit (70-90% of the potential profit) or if option premium is 5-10 cents.

-

The options are usually priced correctly – if the trade looks too good to be true – it usually is (for example – covered call with 100% annualized return)

In conclusion: Option traders have an edge when selling options. Here we just mentioned 2 strategies and 2 studies. You can read more here:

-

Research of the CBOE indexes – index-option-writing-ACG-Feb-2012

-

Read more about selling options edge

-

Covered call screener

-

Naked put screener