Option Samurai platform is designed to help options traders like you sharpen their edge in the market. We provide a suite of tools that utilize advanced technology and options know-how to help you stay on top of the market.

Please check our help portal for in-depth information about the different features and benefits we offer.

The main sections of the platform are:

- Scanner: Scans the entire market.

- Predefined screens: Helps you get started quickly and provide ideas for your own scans.

- Saved scans: Helps you build a consistent workflow in your trading.

- Trade-log: Add trades and track them. This allows us to see open trades on portfolio level and learn from closed transactions.

- Trade analysis: This allows you to analyze a specific trade.

- Alerts and monitoring system (coming soon): you will get alerts and notifications when away from the computer.

Options Scanner:

The options scanner helps you find trade ideas in more than 20 different strategies that fit every market condition. You can scan more than 1.2 million options instantly or enter your watchlist and limit the results to a list of stocks you are interested in.

Compose Scan:

Clicking on the ‘Compose Scan’ window will allow you to build a scan from a new template. Then, pick the strategy from the dropdown menu, click ‘add filters’ and start scanning the entire market!

Saved Scans:

One of the most important aspects of trading is to create a consistent workflow that will allow you to generate profits and improve the process to stay on top of the markets. Saved scans can be bookmarked for quick access, and you can create as many scans as you want to fit different market conditions.

Read here about how to save a scan. This blog post shares tips on how to build a consistent workflow.

Predefined scans:

To help you get started, we created more than 25 predefined screens. You can see them as templates to help you get started and give you ideas on how to scan the market. Each scan will provide you with trade ideas for different market conditions. Still, the best way to use them is to get inspiration from them and implement it in a way that fits your style and goals. You can go over the entire list or use the tags at the top of the page to filter them.

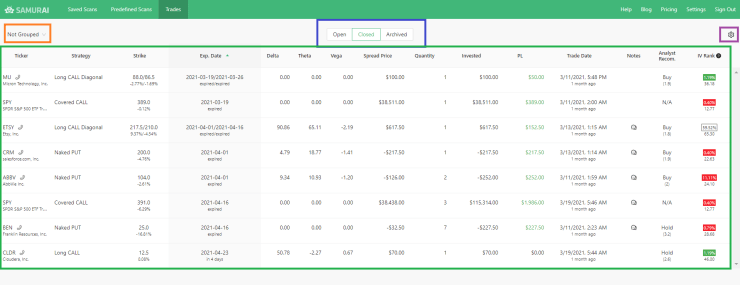

Trade Log:

The trade log has two main sections: Open trades and Closed trades.

Open trades allow you to track your open options trades. You can track your open trades and see statistics not available on other platforms (ROI, Premium left in trade, etc.)

Closed trades allow you to see past transactions and learn from them to improve your trading style.

You can click on ‘add trade’ or click on a scan result and click the ‘trade’ button to access it. Read more on our dedicated KB article.

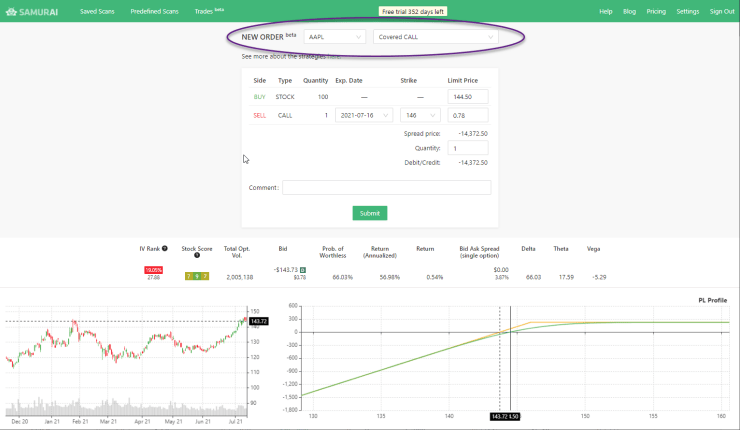

Trade Analysis:

The trade analysis (Trade Order Form) allows us to analyze a specific trade and customize it (strikes, expirations, prices) and see how it affects its potential.

Read more in our dedicated article.

Summary

The platform is feature reach and intuitive to use. You can click on the chat icon on the bottom right of the platform (some adblockers might block it) to easily ask us questions and get more help. You can see an example scan here: and some use cases here:

Read more on our tutorial page and the help portal.

Signup to Option Samurai free trial here (no credit card needed).