Learn. Trade. Profit.

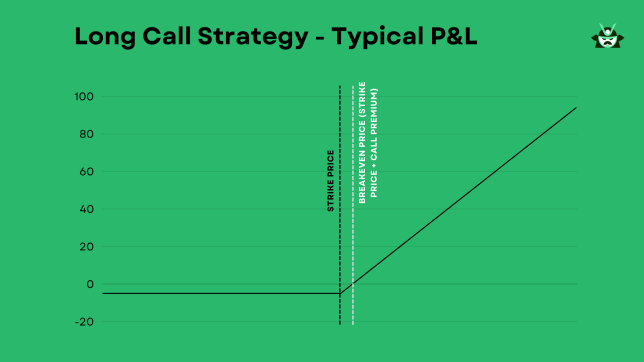

Gaining a Better Understanding of the Long Call Options Strategy

When you first approach option trading, a long call strategy may seem like the most intuitive choice. And for good reason – it’s a…

Recent posts

Categories

Menu